Author, Mike Smith

Author, Mike Smith

Last Updated on August 11th, 2024

This article covers how you can change Euros to Pounds. I’ll also explain how you can get the best exchange rate to change your Euro to Pounds cheaply.

Where can I change my Euros to Pounds?

You can change your Euros to Pounds at a bank or use a currency broker. The cost of changing your Euros to Pounds depends on the exchange rate margin and the strength of the Euro against the Pound that day.

Banks and currency brokers charge a small margin on top of the interbank rate of exchange for Euros to Pounds.

The exchange rate margin will be the biggest cost when you’re converting Euros to Pounds.

Finding the company with the best exchange rate with the lowest costs is the key to changing your Euros to Pounds cheaply.

However, some banks and currency brokers may also add on a transfer fee.

The best advice to find a cheap exchange rate is to compare different companies and consider the state of the current Euro to Pound market.

Let’s break down your options.

Banks

Banks can seem like a familiar choice for changing Euros to Pounds.

However, they are generally more expensive than using a foreign exchange specialist.

Bank exchange rate margins in the UK are usually between 2%-5%.

You can read our article on the exchange rates of the big UK banks here.

To give you a simple example, on a £100,000 transfer, for example, a 3% margin from a bank would cost you £3,000 in exchange rate costs alone.

That is a lot of money to hand over to the bank.

And it’s not just UK banks with pricey exchange rates.

Our research found that the exchange rates offered by the major banks across Europe are consistently poor.

- United Kingdom: the exchange rate margin at HSBC, Lloyds, Barclays and Natwest ranged between 2.0% and 4.6%.

- Spain: CaixaBank, Sabadell, Bankia, BBVA and Santander have an exchange rate margin of 3.8% to 5.1%.

- France: leading banks such as Credit Agricole, BNP Paribas and Societe Generale appear even worse than in Spain, with margins at 4.5% to 5.3%.

- Portugal: exchange rate margins for BPI, Nova Banco and Santander Totta come in at 3.5% to 5%.

- Ireland: AIB, Bank of Ireland and EBS have margins of 4.3% to 5%.

That’s not all – some banks have the cheek to add transfer fees per transaction.

Transfer fees are an additional charge to the exchange rate costs.

In effect, you are being charged twice for the same transaction!

And if you want to make international payments regularly, you’ll incur the transfer fees every single time.

In my opinion, transfer fees are annoying and unnecessary.

I’d recommend avoiding using any provider that charges transfer fees.

Currency Brokers

Currency brokers are also known as currency exchange companies, money transfer companies or foreign exchange brokers.

These names are relatively interchangeable, and they do the same thing.

Their sole purpose is to help you move your money from one country to another.

Currency brokers are highly likely to be your cheapest option to change Euros to Pounds.

You will generally get a better exchange rate using a currency broker than a bank.

However, one thing to note is that some currency brokers also charge transfer fees.

So it’s always worth checking for any added fees before you exchange your Euros.

Another benefit of a currency exchange company is getting better service and support.

You’re dealing with experts who watch the currency markets all day. They can give you knowledgeable support that banks simply don’t provide.

Guidance from currency brokers could include:

- Letting you know when the Euro to Pound market moves in your favour.

- Warning that the currency markets could be entering a risky period.

- Looking at recent trends in the Euro to Pound exchange rate.

This kind of market guidance can help you choose the right time to make your transfer.

Of course, better timing means a better exchange rate.

For a large money transfer, it could potentially save you thousands.

Plus, currency brokers are generally easier and more efficient to use than banks.

International bank transfers are their only focus.

If you are sending a significant sum of money, you don’t want to risk dealing with a hands-off, cumbersome bank.

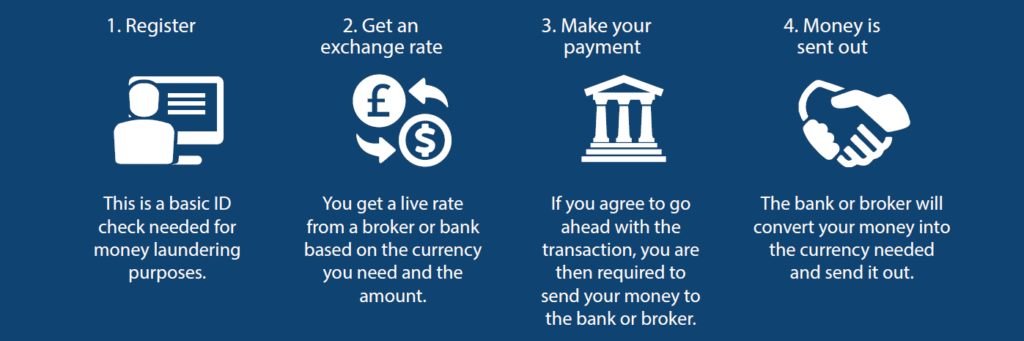

How to change Euros to Pounds (in 4 simple steps)

Whether you decide to use a bank or a currency broker, changing Euros to Pounds is essentially the same.

Here’s how you can do it.

Step 1 – ID Check

Your first step is to create an account with your money transfer provider.

To do this, you must pass an ID check for security purposes.

All money transfer providers will require an ID check the first time you make a transfer.

This check shouldn’t take too long.

For UK citizens, a passport or bank statement is usually enough for this step.

If you’re required to send in documents, and you get them in swiftly, it often doesn’t take more than an hour or two.

Step 2 – Secure an exchange rate

Exchange rates are the main cost of sending money abroad.

Securing the best Euro to Pound exchange rate is the most important part of your transfer.

I’d recommend comparing quotes to find the best exchange rate possible.

Even small changes in exchange rates can make a big difference to the final amount you receive.

If you blindly accept the first exchange rate you find, it could cost you thousands.

When you’re happy with the rate quoted, lock it in with your provider.

Step 3 – Send in your Euros

With the exchange rate secured, your provider will let you know the details of where you need to send the Euros.

Sending in the funds will be just like a standard bank transfer.

Once you’ve sent the Euros, you should get confirmation that they’ve been received.

That’s your part done.

Step 4 – Receive the converted Pounds

Once your funds are received, they will be changed from Euro to Pounds and sent to the recipient’s account shortly afterwards.

After that, the transfer’s complete!

How long does it take to change Euros to Pounds?

Sending money from Europe to the UK happens relatively quickly.

It usually takes 1-2 working days to change Euros into Pounds.

If your funds reach the provider in the morning, this can help the funds arrive faster.

The cut-off time for same-day Euro to Pound transfers at most banks and currency brokers is around 2 pm or 3 pm.

Beat the cut-off time, and the funds can be exchanged and sent to the recipient on the same day.

If the funds reach the bank or foreign exchange specialist after the deadline, they will be sent out the next working day.

Here’s something a lot of people don’t know…

The currency exchange from Euros to Pounds happens in just a few minutes.

It’s quick and easy to change from one currency to another.

Most of the wait comes from the banking system.

Euro to Pound transfers are normally sent via the SWIFT payment system.

While SWIFT is safe and reliable, it’s slow in a world used to instant results.

If you’re in a rush or under time constraints, you can send funds in ahead of time.

This means the funds can be changed from Euros to Pounds almost immediately, and the funds are ready to go when you are.

The information you’ll need for changing Euros to Pounds

To change Euros to Pounds, you’ll need the following information:

- Proof of ID (for your account setup)

- Name and information of the recipient

- IBAN of the recipient’s account

- SWIFT code (also known as the bank identifier code)

You’ll only need proof of ID the first time you send money internationally.

For the transfer itself, the IBAN is the most important piece of information.

This is the international bank account number and how bank accounts are identified across the globe.

You can usually find the IBAN at the top right of a bank statement.

Our IBAN checker will also help you confirm whether or not an IBAN is valid, before continuing with the transfer.

SWIFT numbers are unique to each bank.

If it’s not on your bank statement, you can usually find the SWIFT number on the bank’s website.

Should you get stuck at all, you’ll be able to get all this information at your local branch.

At Key Currency, your account manager will always be at the other end of the phone to help set up your payment information.

How to get the best Euro to Pound exchange rate?

Exchange rates change every couple of seconds.

So, as well as finding a cheap and reliable exchange rate provider, it pays to stay on top of exchange rate trends.

But it’s still easier said than done.

Many currency brokers, not to mention the banks, leave you to fend for yourself to monitor exchange rates.

Why should you be expected to keep a constant eye on exchange rates to spot these changes?

For example, even a 1% swing – which happens all the time with exchange rates – can make a difference of thousands to the final figure.

For a €100,000 transfer, a move of 1% would cost you €1,000.

By using Key Currency, you can get exchange rate alerts when the market reaches a set point or moves in your favour.

Our currency representatives watch the rates all day and can give you expert assistance.

They can help you decide whether it is a good time to change Euros to Pounds.

We have also written forecast guidance to help customers with the Euro to GBP rate, click through for more information!

Quick Summary

If you’re looking to change Euros to Pounds, using a currency broker is likely to be cheaper than a bank.

By using a currency broker, you can:

- avoid paying transfer fees

- get assistance with your payment details

- receive expert guidance on exchange rates

Key Currency: Who are we?

Key Currency is one of the UK’s leading currency brokers.

As specialists in the sector, we aim to make your international money transfers as cheap as possible.

You also get your currency exchange representative.

They will take care of your transfer from start to finish.

You get guidance tailored to your situation to bring you the best possible result.

No need to explain your situation each time you speak to someone new.

Just fast, friendly, and helpful support.

We also don’t operate through any online apps or platforms that leave you to carry out the entire transfer yourself.

We do all the hard work for you.

You can see exactly who we are and who you’ll be dealing with on our About Us page.

What’s more, you can have peace of mind knowing that Key Currency is an FCA-regulated Authorised Payment Institution (No. 753989), and as such, all money transfers are conducted through safeguarded client accounts.

We have a 5-Star “excellent” customer rating on Trustpilot, the highest rating available.

To make a no-obligation enquiry, find out our latest rates, or if you have any questions regarding changing euros to pounds, please request a quote below.