Author, Mike Smith

Author, Mike Smith

Last Updated on June 8th, 2024

Transferring Euros to Dollars is a simple and easy process once you have all the information you need!

In this article, I’ll go through the step-by-step process of transferring Euros to Dollars, how long it will take, the options available, and how to get the most value for your money.

How to Transfer Euros to Dollars (only 4 steps!)

To transfer or change Euros into Dollars you can use your bank, a currency broker, or an online transfer app. Independent money services (broker or online platform) will charge much less in both transfer fees and margin on the exchange rate, compared to your bank.

Whichever service you decide to use, the process is practically the same.

Here are the four steps:

1) Registration

Before transferring Euros to Dollars, you must register and have a standard ID check.

This check, by law, is to prevent any illegal international money transactions.

You will need to provide:

- Name

- Address

- Date of Birth

2) Secure a Euro to US Dollar exchange rate.

The second step in the process will be to get a quote for your Euros to Dollars transfer.

When transferring Euros to Dollars, you are selling Euros and buying Dollars.

Exchange rates move consistently every day. This will affect how many Dollars arrive in your or the recipient’s US bank account.

When you have found a favourable rate, you can lock in the exchange rate with a money transfer specialist or bank.

3) Send in your Euros

When a Euro to US Dollar exchange rate has been agreed between you and your transfer provider, you can then send the amount of Euros you wish to transfer.

The confirmation email you receive at the end of Step 2 will have the provider’s details. This is usually done via regular bank transfer.

4) Your Euros are changed to Dollars and sent.

Once your money transfer service has received the Euros, they will convert them into Dollars.

Once the conversion is complete, they will transfer to the US bank account you specified.

Done!

How Long Does it Take to Transfer Euros to Dollars?

It will usually take 1-2 working days to transfer Euros to US Dollars.

Converting the currency is one of the quickest parts of the international money transfer.

The part that generally holds up the time it takes is clearing funds through the receiving bank.

Depending on which US bank you or your recipient are with, the time it takes for the transfer to complete can vary due to each bank’s different checks, but it is usually within the range mentioned above.

What is the Best Way to Transfer Euros to Dollars? (Costs Compared)

There are various providers out there offering an international money transfer service.

It can be overwhelming when trying to decide who to choose.

Ultimately, there are two main options to consider when transferring Euros to Dollars.

These include either your bank or a money transfer specialist.

A money transfer specialist will be your best option if your Euro to Dollar transfer involves a large amount.

Why?

An independent money transfer specialist can provide more competitive exchange rates and lower fees than leading European banks.

Securing a good exchange rate on your Euros to Dollars transfer means making significant savings.

Banks typically charge higher fees and bigger exchange rate margins on Euro to Dollar transfers.

This is important as the total cost of the transfer will be a combination of:

- Exchange Rate Margin

- Transfer Fees

Euro to Dollar Exchange Rate Margins & Transfer Fees (Explained)

The exchange rate margin is an important consideration when transferring a large amount of money from Europe to the US.

This is where banks fall short of providing value for your money.

Below, you can see the exchange rate margin ranges for banks across Europe for transferring Euros to Dollars.

Spain: Banks in Spain, including CaixaBank, Sabadell, BBVA, and Santander, will typically charge an exchange rate margin of 3% to 4.7%. France: Banks in France, including Credit Agricole, BNP Paribas, and Societe Generale, will typically charge an exchange rate margin of 4% to 5.3%. Ireland: Banks in Ireland, including Bank of Ireland, AIB, and EBS, will charge an exchange rate margin of 4.3% to 5.1%. Germany: Banks in Germany, including Deutsche Bank, Commerzbank, and DZ Bank, typically charge an exchange rate margin of 1.5% to 2.9%.

When comparing this to money transfer specialists, where the typical range of exchange rate margins can be as low as 0.4% – it is worth considering not using your bank.

If you’re looking to send a much smaller amount to the US from Europe, under €5,000, then the familiarity of your bank may still be favourable to you.

However, it is also worth noting that banks will not only charge on the Euro to Dollar exchange rate margin but also add further transfer fees.

Transfer fees added on by European banks tend to be around €20 to €50. An additional charge alongside the markup on the exchange rate.

Money transfer specialists are available, like Key Currency, who do not add any additional fees for transferring Euros to Dollars.

What information Will You Need to Transfer Euros to Dollars?

For your Euros to Dollars transfer to go through, you must provide the following details to the bank or money transfer specialist you choose.

- Name of recipient.

- Account Name.

- Routing Number.

- Bank Account Number.

The one unfamiliar detail here may be the ‘Routing Number’.

In short, the Routing Number in the US helps identify the bank and location of where the account was opened, allowing your funds to be transferred to the right place.

A routing number is 9 digits long and can be found via logging into online banking or on a monthly bank statement.

Another advantage of a money transfer specialist is that they can help you find this information if required.

Making Sure Your Euro-to-Dollar Transfer is Secure

If you do decide to go with a money transfer specialist, then it is paramount that you know the provider you are transferring with is safe.

It’s a big part of any international money transfer; you want the peace of mind that your money is always safe and secure.

Critical protections are in place.

For example, it is essential only to use a money transfer specialist that is Authorised and Regulated by the Financial Conduct Authority or FCA for short.

An FCA-regulated company is required to hold customer money in safeguarded bank accounts.

When transferring Euros to Dollars, this means that your money will be in separate bank accounts designated for only customer transactions.

Using the FCA register makes checking if a company is FCA-authorised easy.

How to Get the Best Euro-to-Dollar Rate

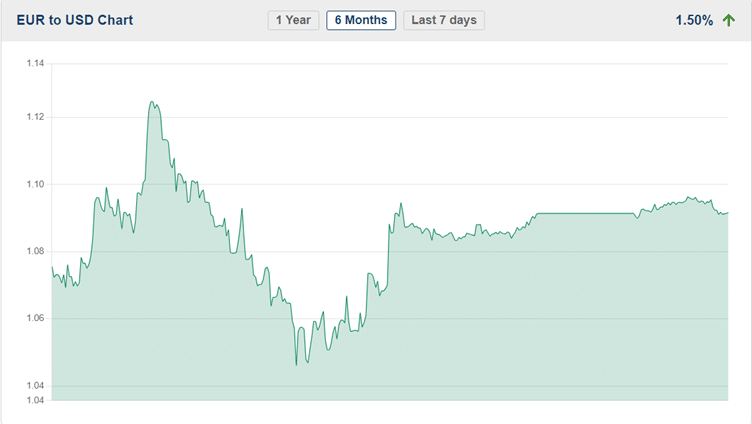

Like all exchange rates, the EUR to USD rate fluctuates daily.

These are its movements in the last 6 months:

Showcasing why finding the best exchange rate is essential.

Monitoring exchange rates is difficult for the regular person, and knowing when a rate is more favourable can sometimes be confusing.

This is why seeking professional support and guidance can be a big help.

Unlike banks, money transfer specialists are experts in keeping track of exchange rates for their customers.

The hard work of finding the best euro-dollar rate available or waiting for it to reach a certain point can be done for you.

So you can sit back and relax!

However, it’s important to note that not all money transfer specialists offer this service; online money transfer platforms that conduct money transfers through apps will again leave you working out the exchange rate for yourself.

Especially with large money transfers, it’s always best to deal with money transfer specialists and traders personally.

Quick Summary

- You can use your bank or a money transfer specialist to transfer Euros to Dollars.

- It usually takes 1 to 2 working days for the transfer to complete, depending on the recipient’s US bank and their clearance checks.

- Ensure they are Authorised by the FCA if using a money transfer specialist.

- You can avoid high exchange rate margins and transfer fees by not using your bank to make the transfer.

- Some money transfer specialists will help customers find the most favourable Euro to Dollar rate.

At Key Currency, we help support many customers with Euro money transfers to the USA. Our team of experts is always available, monitoring exchange rates and alerting customers when to transfer at the right time, saving them money. We have over 2,500 reviews on Trustpilot, achieving an ‘Excellent’ rating. We are a money transfer specialist that you can rely on. We are also Authorised and regulated by the FCA, No.753989; you can rest assured that your money transfer will be completed securely. With competitive exchange rates and no transfer fees, we will happily support you and your Euro to Dollar money transfer. Get a free quote today!Find a Favourable Euro to Dollar Rate and Transfer with Key Currency.