Last Updated on August 9th, 2024

If you’re looking to send money from Belgium to the United Kingdom but aren’t sure where to start?

In this article, we’ll look at the best ways you can make a money transfer from Belgium, what you can expect to pay, how long it will take to arrive in the UK, and much more.

How to Transfer Money from Belgium to the UK (simple process!)

To transfer money from Belgium to the UK you can use your bank or an independent money transfer specialist such as a currency broker or online service. Banks are known to charge much higher transfer fees and offer poor exchange rates compared to other money transfer alternatives.

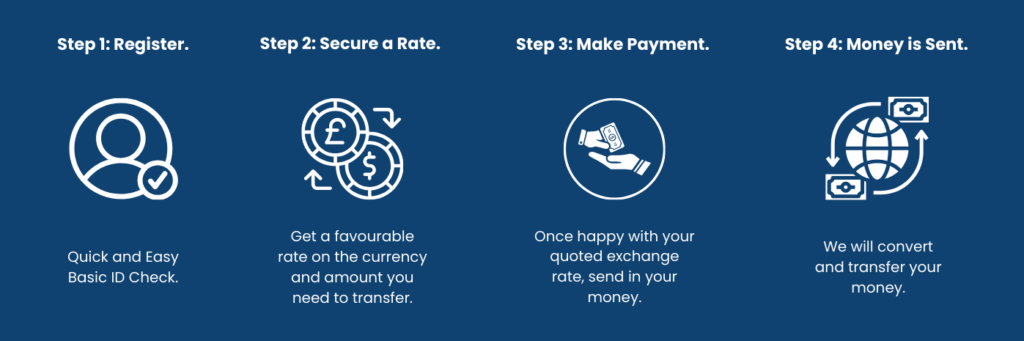

Whichever service you choose, the process for sending the money to the UK from Belgium is pretty much the same.

(1) Register

If you use your bank, you won’t need to register to make an international transfer.

For independent transfer specialists, you will need to, but the registration is very quick and easy.

All it requires is a simple ID check.

This is for money laundering regulations.

Once you’re registered, you won’t need to do so again for future international transactions.

(2) Secure a Euro-to-Pound Exchange Rate

The next step is to secure a favourable euro-to-pound exchange rate, which saves you money.

This is where high street banks fall short.

Independent foreign exchange specialists will offer much better rates for your Euros transfer from Belgium.

In some cases, these services will work with you to find the best rate at the best time.

Like our expert transfer specialists do at Key Currency.

Once you’re happy with the rate quoted to you, it is then locked in.

The rate will not move from this point and your money will be transferred at the quoted rate.

(3) Send in Your Euros

Once you have agreed to a rate, you’ll receive a confirmation email.

This will have all the information about your transfer and where you can send over your Euros.

Always make sure the company you use is FCA-regulated and authorised. This ensures the security and safety of your funds.

(4) Euros Converted and Transferred

Once your money has been received, the money transfer service will convert your Euros into Pounds.

They will then complete the process by transferring the money to your intended recipient, or it could be your personal bank account in the UK.

Done!

Best Ways to Send Money from Belgium

A couple of other considerations are worth mentioning here as to which is the ‘best’ way to send money from Belgium, for you.

- Why are you sending the money?

- How much are you looking to send to the UK from Belgium?

Let’s take a look at why these matter:

If you’re making a small one-off transfer, the excessive fees and less favourable exchange rates may not impact you as much.

In this case, the convenience of using your bank, to make an international bank transfer to the UK could be the best option.

Are you looking to send quick regular transfers of under €1,000? Maybe to a loved one?

An online transfer app such as Wise, Revolut, or Remitly could be the best option via the online payment methods shown above.

This will allow for quicker transfer times whilst also paying much less in overall fees compared to a bank.

Want peace of mind and security when making a large money transfer from Belgium to the UK?

An international bank transfer with a currency broker may be the best option.

Not only can currency brokers save you money by adding no fixed fees and finding the best exchange rate available, at the time of your transfer.

But you have personal traders assigned and consistent communication throughout the process.

This is where other services are lacking, with only online chat-bots available.

Especially for those looking to transfer large amounts regularly, you can build a relationship with a real broker.

These relationships help form reassurance that your money is in safe hands, at all times.

Compare Our Great Euro to Pound Rates

How long will the transfer from Belgium to the UK take?

Transferring money from Belgium to the UK usually takes 1 to 3 days. For most transfers, money will be converted and sent on the same day. The time it takes for the funds to clear into a UK bank account is what can cause delays.

This will vary depending on the bank you or your recipient use in the UK.

As noted above, other methods of payment for quicker transfer times (money arrives in 24 hours) can be used.

The most commonly use here are debit or credit card payments.

But be aware of the additional fees that will be added if you use these methods.

How much will the transfer cost?

The cost of a money transfer from Belgium to the UK can be broken down by:

- Transfer Fees (clearly shown)

- Margin on the Exchange Rate (usually hidden)

Both are common amongst all types of money transfer services, especially your bank.

The final cost will depend on whom you choose to transfer your money.

Let’s take a closer look…

Common Banks in Belgium (total costs)

| Bank | Transfer Fee | Exchange Rate Margin (% of the transferred amount). | Total Cost (for a €5,000 transfer to the UK) |

| ING | €25 | 5% |

€225 |

| BNP Paribas Fortis | 1% of the transferred amount. | 3.1% | €205 |

| BeoBank | 2% of the transferred amount. Max €9.99 | 3.6% | €189.99 |

Online Transfer Apps (total costs)

| Transfer App | Transfer Fee | Exchange Rate Margin (% of transferred amount). | Total Cost |

| Wise | €0.45 | 0.56% | €28.29 |

| Revolut | €0 | 1% | €50 |

| World Remit | €1.99 | 1.5% | €76.99 |

As you can see by the above comparisons, the biggest cost for an international money transfer comes from the exchange rate margin applied by the services.

Unfortunately, for the average customer, this isn’t communicated clearly on most websites.

A lot of the time, a transfer service will display the ‘fixed fee’ which is usually low.

The margin on the exchange rate is taken from how much the recipient will receive at the end.

So, in short, the more you look to transfer the higher the charge and amount taken from the money received.

Which is why it is so important to find a service with lower margins.

How can currency brokers help?

Especially with large money transfers, anything above €5,000, currency brokers become your best ally.

At Key Currency, we charge no fixed fee on international money transfers from Belgium to the UK, regardless of how much you transfer.

Our margins on the euro-to-pound exchange rate are much lower than those of the banks and much more flexible than online transfer services.

We aim to save you as much money as possible by finding the best rate available when transferring money to the UK.

Tom Lobb, Head of Trading at Key Currency, explains this further:

“It’s important when comparing quotes from different providers that you focus on the end amount that will be received in pound sterling.

Banks and online services will display low fees, but, what they don’t state is that these fees are taken before any currency conversion happens. Our margins are added to the overall rate quoted.

Currency brokers convert all of the money you’re trying to transfer internationally from Belgium. Not only that, but we are proactive for clients, we will let you know if the current euro-to-pound rate is in your favour or not.

With other transfer services, what you see is what you get, if you’re not checking the rates yourself, you won’t know if it is good or bad. They provide little support in helping you save as much as you can.”

How much money can I send to the UK?

Technically, you can transfer any amount of money to the UK from Belgium. There are no legal limits in place set by the government. However, services like your bank or some online money transfer apps will put their daily, or monthly limits in place.

For example, a lot of high-street banks will have daily limits of around €10,000-€100,000.

This means you would have to do multiple transfers if sending a significant sum.

We’ve seen how big charges with a bank are, doing them repeatedly, really piles up.

Certain online services also have limits.

Instead of the total amount you can send, if you go over the limit that your account has set, fees will increase.

You can see this on Revolut’s standard fees page.

Transfer limits are another area where currency brokers offer support.

Most currency brokers do not add transfer limits, of any type.

You can send as much as you want, from Belgium to the UK, all in one go.

At no extra cost.

Quick Summary: Money Transfers from Belgium to the UK

- To transfer money from Belgium to the UK you can use your bank, online transfer app, or a currency broker. Each comes with its pros and cons.

- It usually takes 1 to 3 working days for money to arrive in a UK bank account from Belgium.

- To avoid big fixed transfer fees and high exchange rate margin charges, do not use your bank to transfer the money.

- There are no legal limits set for how much money you can send to the UK. Some providers may have daily limits or charge more for higher transfers, however.

At Key Currency, foreign currency exchange is what we do, it’s our specialism. That means we work to transfer your money internationally, securely, safely, and for the best value. With lower overheads than banks, we can offer much lower margins on the exchange rate, passing those savings back to you. You will be assigned to one of our expert traders, all of whom are profiled on our website. They will help you with every step of the transfer process, from registration to making sure recipient details are correct and finding the best exchange rate. if you have any questions, they’re only a phone call away. We are FCA-regulated and have an ‘excellent’ TrustPilot rating from thousands of happy customer reviews. Your money is in safe hands with Key Currency. If you want to transfer money from Belgium to the UK, then please get a quote from us today.Save on Your Money Transfers from Belgium to the UK

Want to Read More?