Author, Mike Smith

Author, Mike Smith

Last Updated on August 4th, 2024

Transferring money to Ireland can seem complicated, particularly after Brexit. Here, I will explain how a money transfer to Ireland works and how you can complete it efficiently, whilst saving money.

Wanting to send money to the UK from Ireland? Our guide on that transfer has all the information you need!

Ways to send money from the UK to Ireland

You have two main options to transfer money from the UK to Ireland:

- Use a bank

- Use a currency broker

Both options are essentially international bank transfers.

Importantly, currency brokers can usually offer better exchange rates than banks which means you will receive more Euros for your Pounds.

Be sure to extend your research beyond your bank.

You’ll likely find you could save money and receive much better guidance and service.

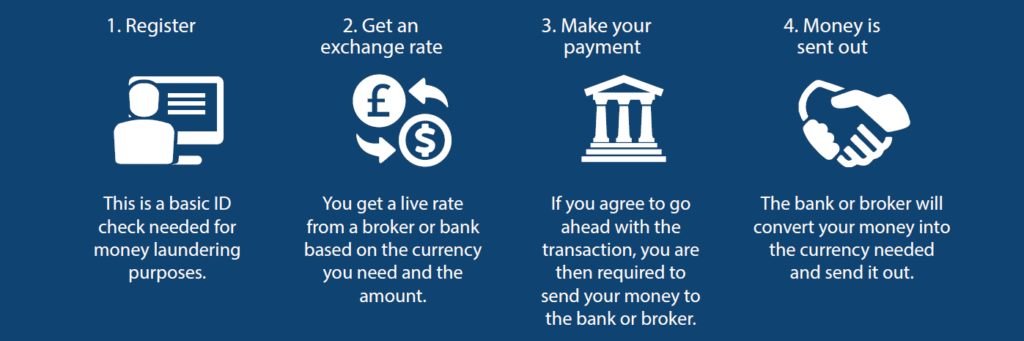

How to transfer money to Ireland (in 4 simple steps)

-

Register your account

To get started with a currency broker, you’ll need to get registered.

This is typically a straightforward ID check.

This is necessary to comply with anti-money laundering regulations, and all regulated brokers will have this procedure.

It shouldn’t take very long, and you’ll only need to do it the first time you make a money transfer.

-

Secure a Pound Sterling to Euro exchange rate

After registering, you’ll be able to access the live market – or your currency exchange representative will do so on your behalf.

This is the most important part of your international money transfer to Ireland.

The GBP/EUR exchange rate determines how much the transfer will cost you.

You’ll want to ensure you get this part right. Exchanging your money at the wrong time can be a costly mistake.

Some currency brokers can help you with the exchange rate.

This can alleviate the pressure of tackling the live currency exchange market alone.

Once you’re happy with the exchange rate for transferring your money to Ireland, lock it in with your provider.

-

Send in your Pounds Sterling

Next, you’ll need to send in your Pounds Sterling for conversion to Euros.

There are some circumstances when currency brokers allow you to secure an exchange rate before sending in your funds.

Banks require your funds upfront.

Having the option to secure an exchange rate before you send in your money can be an advantage if there is a favourable exchange rate and you don’t want to miss it.

-

Receive the Euros in Ireland

Once your currency broker or bank receives the Pound Sterling, the conversion and transfer shouldn’t take long.

The bank or currency broker will send the Euros to the recipient’s account you request in Ireland.

A good currency broker will keep you informed on the progress of your transfer and when the funds land at each step in the process.

How long does a money transfer from the UK to Ireland take?

Even after Brexit, there is no great delay in the time it takes to transfer money to Ireland.

An international money transfer from the UK to Ireland typically takes 1-2 working days.

Under some circumstances, transfers can be completed on the same day.

The UK and Ireland are both part of SEPA (Single European Payment Area).

This means payments between the two countries can still run quickly and smoothly.

Banks and currency brokers both have cut-off times to get transfers sent out on the same day.

This is normally just after midday.

If you have any specific questions regarding the timing of your international money transfer, speak to your currency broker and they’ll be able to give you details relevant to your specific situation.

How much does it cost to send money to Ireland?

The main cost of an international money transfer from the UK to Ireland comes from the exchange rate.

Banks tend to charge around 3-4% in exchange rate costs.

A 4% exchange rate margin from the banks would cost you £4,000 on a £100,000 transfer.

However, currency brokers are specialists and tend to get much closer to the interbank rate.

It’s best to get a direct quote as the exchange rate is dependent on the amount you transfer to Ireland.

On top of the exchange rate, many banks charge additional transfer fees.

These costs can sometimes be hidden, unclear, or confusing.

And they quickly add up if you need to make regular international money transfers.

Shopping around to compare exchange rates helps you find the best exchange rate, avoid unnecessary fees, and can reduce the cost of sending your money to Ireland.

What bank details do I need?

There are a few bits of key information you need to make your money transfer from the UK to Ireland.

You will need:

- Proof of ID (to set up your account)

- Name and details of the recipient (whether a person or a business)

- IBAN of the recipient account

- BIC (Bank Identifier Code) also called a SWIFT code

You’ll only need your ID for registration on your first transfer.

You can often find your IBAN number at the top right of your bank statement.

If you can’t see it on your statement, it’s best to check the website of your bank.

It’ll be a long string of letters and numbers, so it’s worth double-checking it when submitting it to your currency broker.

And you will need to make sure the recipient details are correct for each transfer.

Is there a limit on online money transfers to Ireland?

Transfer limits are annoying, especially when you need to make a large money transfer.

You often find banks set their international transfer limits.

However, if you use a currency broker, there are no limits on the amount you can transfer from the UK to Ireland.

Brokers specialise in transferring large amounts.

This means no limits, no additional transfer fees, and typically better exchange rates.

You don’t want to go through the set-up of an international transfer, only to find a limit in place.

And it’s beyond impractical to have to do a large transfer in multiple transactions.

If you have a large amount to transfer, it makes much more sense to use a currency broker.

Make sure your money is safe when transferring to Ireland

When sending your money to Ireland, it is important, especially if you’re transferring large amounts to keep it safe and secure.

Fortunately, there are ways that you can make sure the money transfer service you choose is regulated.

When researching, make sure the provider you decide on is FCA Authorised.

The Financial Conduct Authority makes sure that a money transfer service complies with regulatory rules and protections.

It is easy to check this, too!

Go to the FCA register and search for the company name.

Quick Summary

- For transferring money to Ireland from the UK, you can use either your bank or a money transfer specialist.

- It will take 1-2 working days for a money transfer to Ireland to complete, in some cases, it can be the same day.

- The main costs of an international money transfer to Ireland consist of transfer fees and exchange rates.

- You will need to provide the IBAN of the recipient account to complete the transfer.

- Make sure you choose a provider who is registered with the FCA for money security and safety.

At Key Currency, we help save you time and money. Having specialised in international money transfers for years, we know how to deliver a cost-effective, reliable service. You will be looked after by a currency exchange expert who will take the time to understand your circumstances. We help get you the best exchange rate possible and take care of all the tedious bits that are often palmed off to the customer. This includes helping you at each stage of your transfer and even letting you know when the exchange rate moves in your favour and the right time to send your money to Ireland. Bear in mind, most banks and money transfer apps don’t lift a finger at all these days. We take a different approach. You can speak to a real person rather than download an impersonal app or lose the will to live to deal with bloated, bureaucratic banks. We have a 5-Star rating on Trustpilot, based on over 2,500 customer reviews. Key Currency is an FCA-regulated Authorised Payment Institution (No. 753989), and as such, all money transfers are conducted through safeguarded client accounts. To compare our rates, or discuss a transfer from the UK to Ireland, just request a free quote.Key Currency