Last Updated on August 4th, 2024

In this article, I’ll explain how you can transfer money from the UK to Cyprus.

You have a couple of options when sending money to Cyprus, and I’ll guide you through how they work and how you can save money.

Looking to send money to the UK from Cyprus? We have all the information you need!

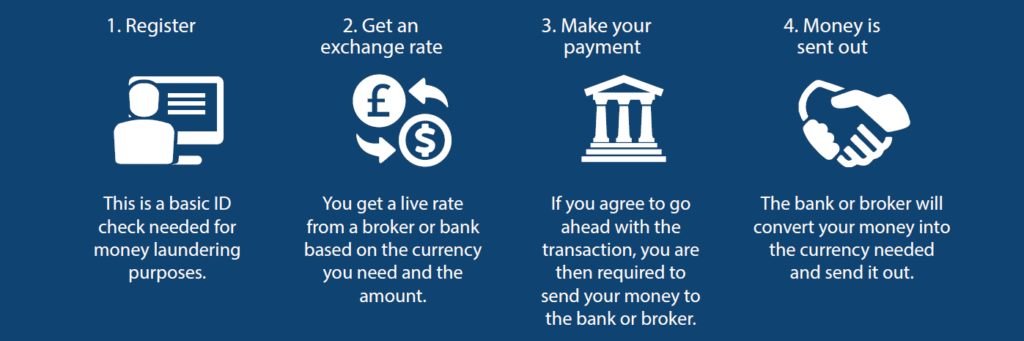

How to Transfer money to Cyprus in 4 simple steps

There are four steps to every international money transfer.

Understanding these steps will give you an advantage when the time comes to transfer your money to Cyprus.

Step 1: ID Check

The first time you register with any money transfer provider, you’ll need to pass an ID check.

This is to prove your identity and comply with anti-money laundering regulations.

This can sound like a daunting task, but it is usually straightforward and just a matter of procedure.

For UK residents, a copy of your passport or driving licence, and on the odd occasion, a utility bill, is often all that’s needed to complete this step.

Most providers make this process fairly quick for you.

An ID check is required at every money transfer provider, so there’s no way around it. It’s just one of those things that need to be done.

Step 2: Secure an exchange rate

The exchange rate is the most important part of transferring money to Cyprus.

Most of the cost from currency transfers is built into the exchange rate.

When any provider quotes you an exchange rate, their cut is built in.

This is why exchange rates differ between providers.

There’s no ‘official’ exchange rate.

For a money transfer from the UK to Cyprus, it’s the Pound Sterling to Euro exchange rate that you need to pay close attention to.

If you can, keep an eye on it ahead of time.

That could be a big help when you come to make your money transfer to Cyprus, as you can get an idea of what sort of exchange rate to expect.

Once you get an exchange rate you’re happy with, lock it in with your provider.

Many exchange rate providers will require you to send them a certain percentage of the full amount as a deposit before you can secure an exchange rate.

Step 3: Send in your Pounds

The next step is to send in your Pounds to be converted into Euros.

You want to make sure you send it to the right place and get the bank details correct.

But fret not, your money transfer provider will make it clear where you need to send the money.

Some currency brokers, like Key Currency, will take the time to explain the process thoroughly and guide you through it from start to finish.

Once you’ve sent the money, you’ve done your job!

Step 4: Your Pounds are converted to Euros

Once the Pounds reach your money transfer provider, they’ll carry out the currency exchange at the agreed rate.

Your Pounds will be converted to Euros and sent straight to your recipient.

It’s then just a case of waiting a few days for the money to arrive in Cyprus.

How long does it take to send money to Cyprus?

It usually takes 1-3 working days to transfer money from the UK to Cyprus.

As Cyprus is in the Eurozone, transfers often use the SEPA payment system.

This is good news for you.

SEPA transfers are one of the quickest ways to make international money transfers.

The currency exchange itself is the quickest part of the process.

If it does take a day or two, it’s the clearing time from the banks at each end that tends to take the most time.

Unfortunately, there isn’t a way to speed this up.

If you have a strict deadline for the payment in Cyprus, plan the clearing time into your timeline.

Information you’ll need for a Cyprus money transfer

You’ll need the following information to send money to Cyprus:

- Your name and the recipient’s name

- Recipient’s account number

- Recipient’s contact details

- Recipient’s IBAN number

I’m sure most of those details will be nice and easy for you.

But you perhaps won’t know the IBAN.

IBANs aren’t something you’ll likely come across in day-to-day banking, but they’re essential for sending money internationally.

IBAN stands for International Bank Account Number.

They allow bank accounts to be identified from anywhere in the world.

You can usually find the IBAN on your bank statement.

Or, if you don’t have a bank statement to hand, IBANs are often listed on your bank’s website.

You’re looking for a 28-digit string of numbers and letters.

Here’s how IBANs typically look in Cyprus:

- Country code: CY for Cyprus

- 2 Digit Check number

- 3 Digit Bank Code

- 5 Digit Bank Branch Code

- 16 Digit Bank Account Number

If you can’t find your IBAN, don’t worry. Just give a currency broker like Key Currency a call.

They will be able to help talk you through how to find your IBAN.

Money transfers to Cyprus: Your best options

If large international transfers are new to you, you may not have heard of a currency broker before.

Currency brokers are specialists in helping people send money from one country to another.

If you need to transfer a large amount of money from the UK to Cyprus, a currency broker is probably your best option.

Here’s why:

Currency brokers typically offer better exchange rates than banks.

Banks usually charge 3%-4% in their exchange rate margin.

Let me show you how that would work.

On a transfer of £100,000, a 4% margin would mean you’re giving £4,000 to the bank in exchange rate costs alone.

This is a significant cut whichever way you spin it, and obviously, that cost increases the larger your transfer to Cyprus is.

Why pay more?

And it doesn’t stop there.

With banks, you’re just a number in the system.

Currency brokers will take the time to understand the reason for your transfer to Cyprus whilst working on getting you the best possible exchange rate.

Let’s say you’re buying a house in Cyprus, for example. Your transfer will likely have a deadline for that house purchase to complete.

Your currency broker can watch the markets and discuss when to make the transfer in time for your house purchase.

Some can also set rate alerts to let you know when the Pound to Euro exchange rate reaches a certain point.

You simply don’t get that from a bank.

You’re left to your own devices. It’s all on you.

If you’re making a large money transfer to Cyprus, I’d suggest using a currency broker. They’re specialists who will take care of you and make sure you get the best possible exchange rate.

Avoid fees when sending money to Cyprus

Some money transfer providers add extra charges every time you make a transfer.

As we’ve covered, you’re already paying for your transfer at the exchange rate.

So why are there extra charges?

Your guess is as good as mine.

I think it’s ridiculous that there are still extra charges on top of your exchange rate.

A cynic might say that adding a small charge to each transfer might lead some less-knowledgeable customers to think that this is the only charge.

A flat £15 charge, for example, sounds reasonable to transfer money to Cyprus.

Advertising this loud and proud on their website might make an honest, untrained customer think they’ve got a good, simple deal.

But when you understand that most of these companies are also taking a significant percentage in the exchange rate, it doesn’t sound quite so good.

It’s cheeky, bordering on outrageous in my opinion.

Make sure you avoid these fees wherever you can.

Most currency brokers don’t charge additional fees, and that’s the case at Key Currency.

With us, the figure you’re quoted is the final amount the recipient will get in their bank account at the end of it.

No catches. No extra charges. No cheek!

How to make sure your money transfer to Cyprus is safe

It’s a good idea to make sure any currency broker you use is Authorised by the FCA (Financial Conduct Authority).

All authorised currency brokers keep client funds in ring-fenced and safeguarded client accounts.

Checking the FCA register is the best way to get peace of mind that things will be done correctly when you transfer money from the UK to Cyprus.

Quick Summary of sending money to Cyprus from the UK

- To transfer money from the UK to Cyprus you can use a bank or currency broker.

- Transfers to Cyprus should take 1-3 working days.

- A currency broker is often the cheapest way to transfer money to Cyprus.

- Use a provider that doesn’t have unnecessary additional fees.

- Make sure you use a money transfer specialist that is Authorised by the FCA

Key Currency: About Us

Key Currency is a UK-based currency broker.

We provide great exchange rates, charge no fees, and give you a friendly service.

You’ll also get your own personal Account Manager who will deal with your money transfer from start to finish.

Once you explain your currency exchange requirements, they’ll watch the market closely to help you make the transfer when you’ll get the best exchange rate.

They’ll walk you through the entire process of sending money to Cyprus.

If you have a question, they will be your point of contact to answer it for you over the phone.

You can see who we all are on our About Us page.

We don’t hide behind corporate logos or slogans and are instead, honest and transparent.

You get a personal service that saves you money on your international transfers.

Key Currency is Authorised by the FCA (No.753989). All transfers are conducted through safeguarded client accounts for your peace of mind.

We also have a 5-star customer rating on Trustpilot from over 2,500 customer reviews.

If you want to transfer money to Cyprus or find out more about our service, request a free quote below.