Author, Mike Smith

Author, Mike Smith

Last Updated on May 6th, 2024

As money transfer specialists, we have helped thousands of customers transfer money to and from the USA.

One big question people have about US international transfers is routing numbers.

Specifically, what they are, why they’re needed, and how to find their own.

In this article, we’ll go through everything you need to know about routing numbers. To stop any future confusion!

Get Great US Dollar Rates Today

What is a Routing Number?

Let’s start at the very beginning.

Firstly, there are different abbreviations you might see used for routing numbers.

These include BRN (Bank Routing Number), RTN (Routing Transit Number), ABA routing number (American Bankers Association) or, ACH routing number (Automated Clearing House).

If you see any of these above used, they will be referring to a routing number.

But, what exactly is a routing number?

A routing number is a nine-digit code that American banks and financial institutions use for identification. It tells banks, or money transfer services, where to send your money, and do so correctly.

Routing numbers are an essential part of the American banking system.

They are used consistently for domestic and international transactions, helping them to be efficient and secure.

The United States is the only country to use routing numbers.

If you want to send money to the USA, you must know the recipient’s routing number for a smooth, error-free transfer.

How Do Routing Numbers Work for International Transfers?

A routing number helps the identification and verification of a recipient’s US bank and account.

The routing number should help confirm the pair match up.

For an international money transfer, the routing number would go through the following steps:

Where Can I Find a Routing Number?

You can find your routing number on bank statements, at the bottom of a cheque or by logging into your online banking and going to your account details.

It is worth noting, that routing numbers are used to identify local banks.

In UK terms, think of a routing number like a sort code.

So, your bank account number (specific to your account) and routing number (specific to your bank) are entirely different.

A routing number for a bank will be used by all who have an account with that particular bank in the US.

With that in mind, you could also ring your local banking branch and get the correct routing number from customer services.

For those sending money to the USA, if you know where your recipient lives and who they bank with, there are various bank code websites that you can look through to find the right routing number.

For an International Transfer, Do I Only Need the Routing Number?

In short, no.

As we’ve seen from the above, it will only identify the correct bank of the recipient.

A routing number isn’t the only piece of information needed to complete an international money transfer to a US bank account. You will also need to provide:

- Recipient’s Name

- Account Name

- Routing Number

- Bank Account Number

Save on Your Money Transfers to the USA

Wrong Routing Number? What Can Happen…

As with all international money transfers, having the right details is so important.

The same can be aid when providing a routing number.

Giving your bank or transfer service the wrong routing number can lead to:

It’s always vital to double-check, then check again, all the information you need!

Unlike most online money transfer services and banks, the team at Key Currency will do everything possible to make sure the information you give is right.

Tom, Head of Trading at Key Currency, talks through the process:

“To check the banking details that customers provide are correct, we will call them and verbally confirm the details we have on the phone, checking that they match with what they have sent over.

What sets us apart from other providers is that we will go the extra mile to support our customers.”

It can be frustrating when an international transfer has any sort of issues.

But, everyone is human and typos happen!

That’s why Key Currency always makes this final check of information. Before continuing the transfer process.

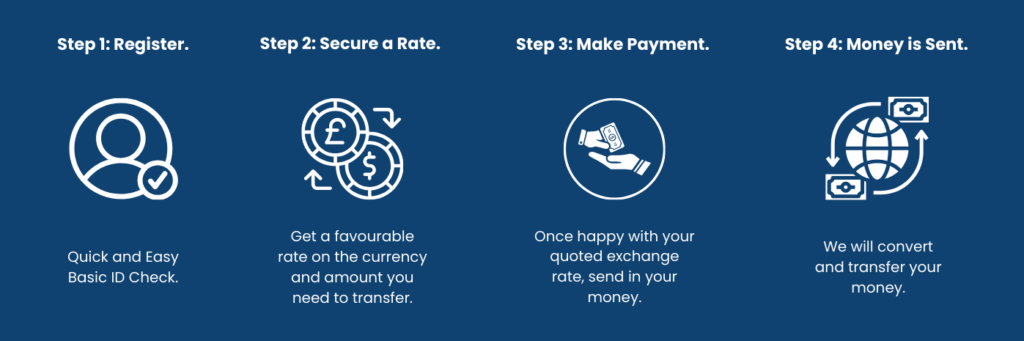

Get Better Value for Your Money Transfers to the USA with Key Currency

At Key Currency, we provide an international money transfer service that helps people avoid paying high fees with their bank.

You’ll have real people to talk to who are experienced and experts in foreign currency exchange.

Their job is to find the best exchange rates available and make the transfer smooth and stress-free while saving you money.

We charge no transfer fees for sending money to the or from the USA.

All customer money is kept in safeguarded accounts.

As an FCA-authorised company, we comply with their regulations, ensuring complete security.

Don’t just take our word for it. Read some of our ‘Excellent’ Trustpilot reviews.

If you’re looking to transfer money to the USA, or want further help and advice with routing numbers, then please get in touch with our team today!

Want to Read More?