Author, Mike Smith

Author, Mike Smith

Last Updated on August 7th, 2024

IBAN transfers are a vital solution should you find yourself needing to transfer money internationally.

If you have never made an international bank transfer before, it’s likely you will have many questions about how an IBAN transfer works, and how long it will take to process.

In this article, we’ll take an in-depth look at how IBAN transfers work, the time they take, and how to make the whole process as simple as possible.

What is the average time it takes for an IBAN transfer to take?

The time taken for an IBAN transfer depends on variables such as the countries, banks, and time zones involved.

An international IBAN bank transfer typically takes between 1 to 5 working days. As a general rule, IBAN transfers within Europe are quicker than transfers across different time zones. The time taken also depends on bank verification processes.

Here are some helpful comparisons of average times between different countries:

UK to USA

1 to 3 working days.

It typically takes 1 to 3 working days to transfer money from a UK to a US bank account. The time taken varies because different US banks are often slower than others at clearing your funds.

UK to Spain

2-3 workings days.

Sending money to Spain from the UK usually takes 2-3 working days. The Spanish bank receiving the funds will need to do their own internal checks before they clear your money into the account.

UK to Australia

3-4 working days.

An IBAN money transfer to Australia by your bank takes around 3-4 working days for your money to arrive in Australia.

UK to Canada

2-3 working days.

It usually takes 2-3 working days for your Pounds to arrive in Canada using an IBAN transfer service.

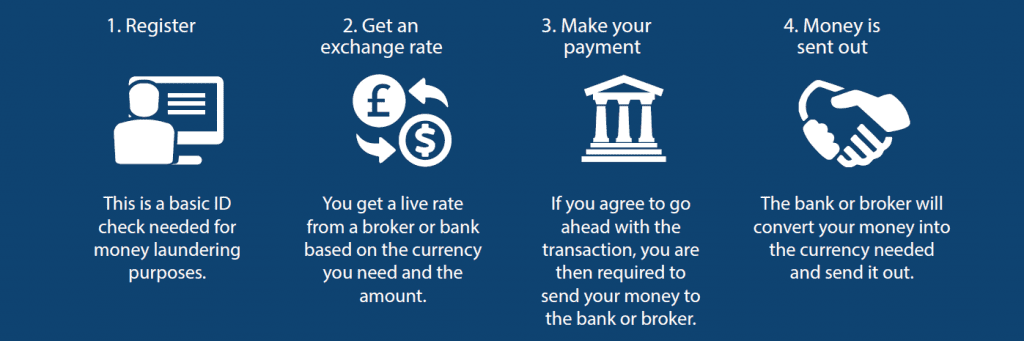

How an IBAN transfer works

An IBAN transfer should be a straightforward process, and is conducted in just a few easy steps.

Firstly, you as the sender instruct your bank to start the international transfer process, and provide the recipient’s IBAN number.

For example, in Spain the IBAN has 24 characters, comprising our full account number preceded by 4 other characters. The first two are the country code (ES) followed by two check digits.

A Spanish IBAN number will something like this – ES91 2100 0418 4502 0005 1332.

Your bank will then clarify this account information and process the transfer request. The funds are then debited from your account and sent directly to the recipient’s specified bank.

When the funds are received, they credit the amount to the relevant account. The transfer is completed when the recipient’s bank credits the account balance and verifies the funds that have been sent.

The IBAN transfer process is recognised as they best way to carry our secure and accurate transactions between individual banks across international borders.

What can cause delays with IBAN transfers?

There are several different factors which can potentially delay an IBAN transfer. The main reasons are as follows:

Currency Conversion

When the transfer is being made between different currencies, for example, Pounds to Euros, the transfer will require currency conversion.

The time your bank takes to convert the currency can cause a delay in the transaction time.

Working Days and Time Zones

Of course, we have to remember that all banks adhere to their local time zones and therefore working days.

If the IBAN transfer is sent at the weekend, or before a bank holiday in the time zone of either the senders or recipients bank, the transfer time is affected by the non working days.

Internal Payment Process

Both the sender’s bank and the recipient’s bank will most likely operate with different payment processes or internal procedures such as additional verification measures, which may again affect the transfer time.

Fraud Prevention Measures

For compliance reasons, all banks have to ensure they have strict security checks to avoid any fraudulent activities.

Should a transaction appear to be suspicious for any reason, it may undergo additional checks and verification, resulting in delays.

What Happens if an IBAN Transfer can’t go through?

In our experience it is rare, but on occasion, an IBAN transfer can potentially have issues which can prevent it from being completed.

In the event that this should happen with your IBAN transfer, the funds are typically returned to the sender’s account.

Our top tip is to thoroughly check the details of the recipient’s IBAN, as one incorrect digit can lead to the transfer being rejected.

Quick Summary

- An IBAN transfer will usually take around 1 to 5 working days. This varies depending on the country you’re sending money to and several other factors.

- The process is straightforward and making sure to have the right recipient’s IBAN number is important.

- It is rare for IBAN transfers not to go through.

- An IBAN transfer is one of the best ways to send money abroad.

How Key Currency Can Help with Smoother IBAN Transfers

At Key Currency we are here to assist you to ensure a smoother IBAN transfer process.

As an FCA-regulated company, your money is always secure in client safeguarded accounts during the process.

We deal with international money transfers on a daily basis and are industry experts at helping you manage your transactions.

With our competitive exchange rates, lower fees, and personalised service, we work with you from the initial point of contact to ensure your transfers are efficient and cost-effective.

Our industry expertise helps you navigate the complexities of currency conversion and streamline your international payments.

Get a free quote today with us and ensure your international IBAN transfer is smooth and seamless.

You May Also Like Reading…

How to Transfer Money to France

Transferring money from the UK to Germany