Last Updated on May 7th, 2024

Looking to send money abroad and save thousands? You may find a currency broker a better and cheaper way than using a bank or online app.

(1) You have your payment details checked

One common mistake in international money transfers is with the beneficiary details (where you want your money sent).

Plenty of places leave you to your own devices, and inevitably mistakes happen and money goes missing.

We hear it all the time from customers who have dabbled with online platforms. It’s why we double-check the details to prevent problems.

It can take a long time to recall missing funds from foreign banks, so prevention is better than cure..

(2) Guidance on exchange rates

A lot of customers find it difficult to know the right time to exchange their money.

Exchange rates change every few seconds.

It probably isn’t the best use of your time or energy to watch exchange rates move around all day.

While no one has a magical crystal ball, you may find it very useful to speak to someone who is familiar with the daily patterns in rates and is aware of upcoming news and events.

A currency broker can work with you to achieve a favourable rate and avoid market risk, potentially saving thousands in the process.

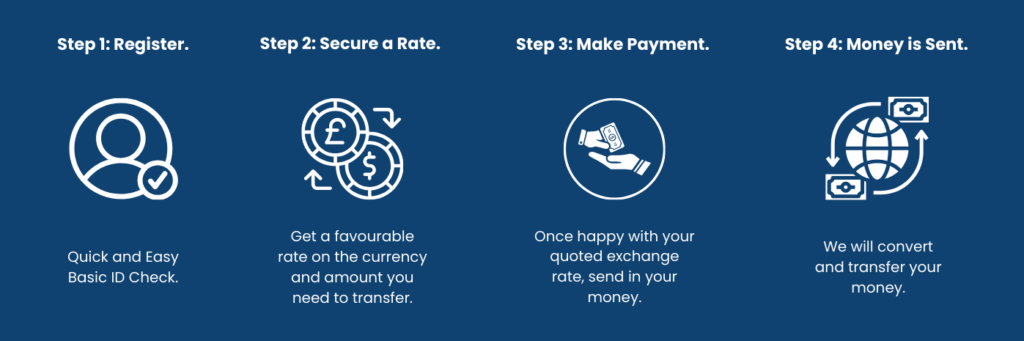

(3) You know what’s happening with your money

No one wants to be left in the dark.

Particularly if you are sending a large sum of money.

It’s perfectly reasonable to want to know where your money is when it’s been sent out, and when it’s due to arrive at the other end.

You’d be amazed how many money transfer companies don’t bother with basic communication.

A good currency broker will talk you through the money transfer process, and keep you informed at every stage!

Banks and currency brokers compared

If you need to send currency abroad, you have a choice of whether to use a bank or a currency broker.

As a general rule, banks charge up to 4%-5% for currency transfers.

Currency brokers will normally cost a lot less, so it’s best to get a comparative quote.

A currency broker can provide:

• More competitive exchange rates

• Lower (or no) fees, and

• Hands-on help and guidance

• Faster processing times

The customer gets a better deal all around.

Quick Summary

Currency brokers offer an alternative to banks.

The main benefits of using a currency broker are:

• Competitive exchange rates

• Low or no transfer fees

• Faster transfer times

• Guidance on exchange rates

• Making things easier for you

Key Currency is a leading UK currency broker.

We can help you achieve a great exchange rate and won’t charge you any fees for your transfers.

We aim to take the stress and hassle away from money transfers by doing all the hard work for you.

As part of our service, we can discuss and agree on the right time to exchange your money, and you can speak to the same person at all stages of your transfer.

We have gained a 5-Star “excellent” rating on the customer review site Trustpilot based on over 1,700 individual reviews.

Key Currency is an FCA Authorised Payment Institution (No. 753989). You have the peace of mind of knowing that all money transfers are conducted through safeguarded client accounts.

If you feel our service could be of use to you, please request a free quote below.

Author,

Author,