Author, Mike Smith

Author, Mike Smith

Last Updated on August 16th, 2024

In this article, I’ll explain how you can transfer money from the UK to Germany easily and cheaply. You can find out how to make your money transfer to Germany without any of the usual financial jargon.

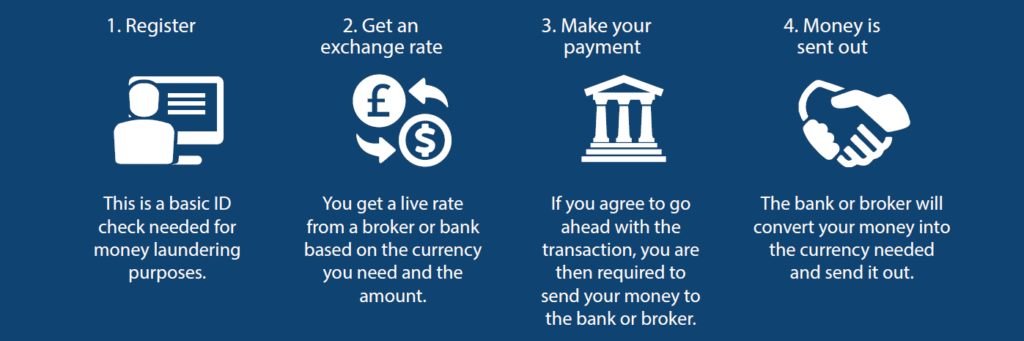

Transfer Money to Germany in 4 Simple Steps

There are 4 simple steps for transferring money from the UK to Germany.

The steps remain largely the same, regardless of which provider you use.

Step 1: ID check

You’ll need to pass an ID check to set up an account with your chosen money transfer provider.

This is required to comply with anti-money laundering regulations.

For UK residents, a copy of your passport or driver’s license and a utility bill is typically enough to open your account.

It’s usually quick and straightforward.

An ID check is necessary regardless of the provider you use.

Step 2: Secure an exchange rate

The exchange rate is the most important part of your transfer as it largely determines how much it costs.

The Pound to Euro exchange rate is needed for a transfer from the UK to Germany.

When the Pound is strong, you’ll get more Euros for your money.

So, you should aim to make the transfer when the Pound is strongest.

You should also be aware that some providers offer better exchange rates than others.

There’s also no ‘official’ exchange rate.

There is the interbank rate, which is what you’ll see displayed on Google.

This is used by banks to trade between themselves, and unfortunately, it’s not an exchange rate that customers like you or I can achieve.

You’ll want to get an actual exchange rate quote to see what you can achieve.

Once you’ve found an exchange rate you’re happy with, lock it in with your provider.

As a tip, many providers will require you to send in a percentage of funds as a deposit before you can lock in an exchange rate.

Step 3: Send in your Pounds

Once you’ve agreed and secured an exchange rate, you’ll need to send in the total amount of Pounds to be converted.

Your provider will make it clear where you need to send the funds.

Once you send the funds, that’s your part done.

You can sit back and relax.

Step 4: Your Pounds are converted to Euros

Your money transfer provider will convert your Pound into Euros at the exchange rate agreed upon.

It’s then just a case of waiting for your Euros to arrive in the German bank account.

You’ll just need to wait for the funds to clear at the receiving bank.

Once the funds arrive, their job is done!

For many people, making a large money transfer to Germany can be a momentous moment.

If that’s the case, open a bottle of champagne (or German gluhwein) to celebrate.

The Best Ways to Transfer Money to Germany

Various methods are available for transferring money to Germany, these include:

- International Bank Transfer

- Debit or credit card payment.

- Google or Apple Pay.

- SWIFT payment.

- Cash pick-up service.

An international bank transfer is a good option for a transfer to Germany. It is one of the most secure methods and usually a lot cheaper than alternatives.

Money transfer services that offer bank transfers to Germany include your bank and currency brokers, it’s important to compare both before deciding on which you will use.

Banks

Banks may spring to mind when making a large money transfer to Germany.

Familiar? Maybe.

But cheap? Think again.

Most banks have big exchange rate margins on international transfers.

The exchange rate margin is the cost that’s built into your exchange rate.

From my experience, banks usually charge between 3%-4% on international transfers.

On a transfer of £100,000, this means a cost of £3,000 to £4,000.

This is hugely expensive.

It’s also annoying that as well as having huge charges, banks often have typical red tape and bureaucracy.

Currency Brokers

Currency brokers offer an alternative to bloated banks.

They are currency exchange specialists.

They transfer large sums of money all the time and don’t have expensive overheads.

This is how they can provide better exchange rates.

And how you can get a better exchange rate!

Ultimately, currency brokers make international transfers cheaper and give you a more efficient service.

Surely, it’s a no-brainer to use a currency broker rather than a bank for large international money transfers.

What Information Do You Need for a Money Transfer to Germany?

I’m sure you’ll want to be as prepared as possible for sending money from the UK to Germany.

The best way to do that is by getting all the details and necessary information for the transfer ready beforehand.

This is the information you’ll need:

- Your name and the name of the recipient

- The recipient’s account number

- The recipient’s contact details

- The recipient’s IBAN

If you’ve not heard of IBANs before, they are the number used to identify bank accounts from anywhere in the world.

In Germany, IBANs follow this format:

- Country code – DE for Germany

- 2-digit check number

- 8 digits for the German bank code

- 10 digits for the individual bank account number

You’re looking for something that looks a little like this:

DE89 4806 0054 0623 0220 00

You can often find the IBAN on a bank statement or the bank’s website.

It’s not something that most people are familiar with though, so don’t worry if you can’t find it.

Call your bank or a currency broker who will be able to help you find it.

How Long Does it Take to Send Money to Germany?

Money transfers from the UK to Germany are generally quite quick.

It typically takes 1-3 working days to transfer money from the UK to Germany.

As you’re sending money to the eurozone, the transfer will use the SEPA payment system.

SEPAs are one of the quickest types of international money transfers.

All in all, it should be a quick process of around 1-3 working days.

Weekends or bank holidays can affect the time taken too.

The currency exchange from Pounds to Euros is the quick part!

Most of the wait is down to clearing time at the banks.

How to Avoid Paying Fees for a Money Transfer to Germany

Some international transfer providers add one-off fees to every transfer you make.

Again, it’s often banks that are guilty of adding these additional fees.

But a lot of the money transfer apps do the same thing.

As we’ve established though, there are costs already built into the exchange rate.

You shouldn’t be forced to accept these extra fees.

You’re just being charged twice for the same transfer!

I wouldn’t put up with this.

I’d recommend finding a currency broker, like Key Currency, that doesn’t charge you any additional fees.

Making Sure Your Money is Safe

The best way to make sure your currency broker is safe is to make sure that they are Authorised by the FCA (Financial Conduct Authority)

All FCA Authorised currency brokers must keep your funds in ring-fenced and safeguarded client accounts.

This is the best way to ensure that your money is safe when transferring it to Germany.

Check the FCA register to see whether a currency broker is FCA authorised.

How to Get a Great Exchange Rate on Transferring Money to Germany

The power to get a great exchange rate is in your hands.

In the perfect world, we’d all have the time to study currency markets in detail, speaking to all the experts possible to come up with the best time to make a money transfer.

But who’s got the time for that?

This is where we come in.

At Key Currency, your account representative will watch the currency market for you all day.

We’ll listen to the purpose of your transfer and discuss with you the best time to make your transfer.

You can even set up rate alerts when the Pound to Euro exchange rate hits a rate that you’re after.

If you were to use a bank or an app-based money transfer company, you’d be entirely on your own.

You’d be forced to manage the entire transfer by yourself and keep track of the exchange rate without the support of an expert.

With a large money transfer, that’s a lot of pressure.

I’m not sure I’d want the sole responsibility of transferring thousands to a different currency.

I’d want all the help I could get.

Let our account representatives analyse the market for you and help you make the best decision on the timing of your money transfer to get the best exchange rate possible.

Quick Summary

- To transfer money from the UK to Germany, you can use a bank or a currency broker.

- Transfers from the UK to Germany should take 1-3 working days.

- Your cheapest option to transfer money to Germany is usually a currency broker.

- Use a provider that doesn’t charge you unnecessary and annoying fees.

- Some currency brokers like Key Currency can assist you by watching exchange rates on your behalf.

Key Currency is a British-based, independent currency broker. We do things differently from the big banks and other currency brokers. You get your account representative who will always take care of your currency transfers. We will closely watch the markets to try and get you the best possible exchange rate. We’re completely open and transparent, and you can see all our employees on our website. We don’t hide behind corporate logos, policies, or small print. You get a personal service that saves you money on your international transfers. Key Currency is Authorised by the FCA (No.753989). All transfers are conducted through safeguarded client accounts for your peace of mind. We also have a 5-star customer rating on Trustpilot from over 2,500 customer reviews. If you want to transfer money to Germany or find out more about our service, request a free quote below.Key Currency: A refreshing alternative

Author,

Author,