Author, Mike Smith

Author, Mike Smith

Last Updated on August 12th, 2024

It can be difficult to find the right company for your international money transfers. In this article, I’ll explain how you can save money by finding the best exchange rate company for you.

What is an exchange rate company?

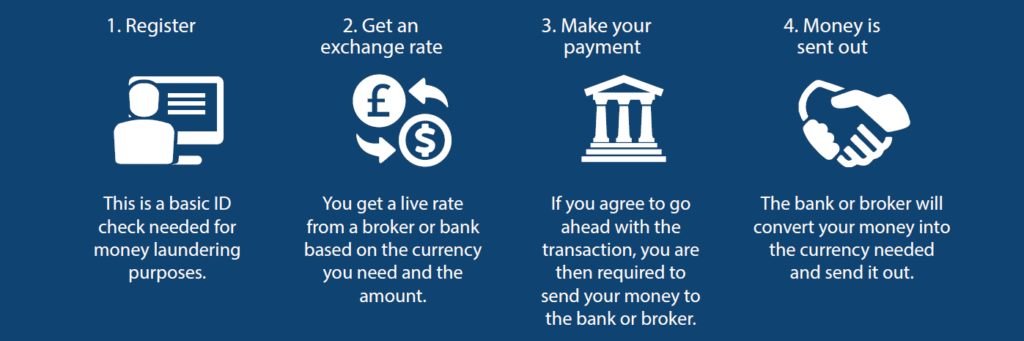

Exchange rate companies offer an alternative to banks for international money transfers.

An exchange rate company is also known as a currency broker or money transfer specialist.

The benefit of using an exchange rate company is it can be cheaper, quicker, and easier to use than a bank.

Types of exchange rate companies

When you send money abroad, you have four options:

- Banks

- Currency Brokers

- Money Transfer Apps

- Money Remittance Companies

While each type offers exchange rates, they tend to serve different customers.

I’ll run through each option below.

Banks

For a lot of people, banks seem like an obvious way to send money overseas.

While a bank offers a convenient option for smaller amounts, I would recommend avoiding the big banks for a large international transfer due to higher costs and lack of service and transparency.

The bottom line is banks are unlikely to offer you the best exchange rates.

Our research found that banks typically have exchange rate costs of between 3%-4%.

If you were transferring £100,000 for example, a bank could end up taking £4,000 from this transfer.

This is a lot of money to pay a bank given there are cheaper specialists out there.

What’s more, it can be a nightmare trying to find the exact costs a bank will charge you.

Most of the banks we’ve looked at make it difficult to find out the costs of an international money transfer up-front.

Banks tend to leave the costs to the end of the process and by that point, most people just go ahead anyway.

Currency Brokers

Currency brokers tend to be the preferred option for large international transfers.

There are several reasons why currency brokers are a better option for larger amounts:

- They typically provide better exchange rates

- There aren’t payment size limits

- You can better service and support

I know from experience that many people feel more comfortable dealing with a real person when transferring large amounts of money.

Currency brokers will assign you a person who will handle your transfer from start to finish.

They can take the time to understand your transfer in detail, answer any questions you may have, and help set up all the payment details.

You can also get valuable guidance on foreign exchange markets that’ll give you the best possible chance of securing a great exchange rate.

At Key Currency, our expert representatives can offer you all of this, plus exchange rate alerts and highly competitive exchange rates.

Money Transfer Apps

Money transfer apps are the newbies in international money transfers.

More apps are flooding into the foreign exchange market all the time.

Each has its own new technology and unique spin on transferring money online.

Money transfer apps provide a do-it-yourself option.

They remove any human interaction or support, wherever possible.

The money transfer apps that you may be familiar with are Wise (previously TransferWise), Revolut, Paysend, CurrencyFair, and PayPal.

One issue to be aware of is if something goes wrong, you can’t call someone. The support is via email and webchat.

When you’re dealing with large amounts, this makes most people feel uneasy.

Money Remittance Companies

Money remittance companies are best for sending relatively small amounts of cash to friends and family overseas.

Sending cash is the quickest way to move money abroad.

This may be a little surprising, but cash transfers are quicker because they don’t have to clear through the banking system.

The catch is though, there are limits on how much you can transfer.

Most money remittance companies have limits of £2,000 per transfer.

Although sending cash is the quickest way to move money, it is typically the most expensive.

The two big players in the money remittance world are Western Union and MoneyGram. They have branches scattered all around the world, so they are never too far away from you or your recipient.

How exchange rate companies can save you money

Currency brokers and money transfer specialists are designed to operate more efficiently than banks, enabling them to offer better exchange rates.

With much lower operating costs than a bank, a currency broker can get closer to the interbank exchange rate.

Another thing to watch out for is that banks charge unnecessary fees in addition to exchange rate costs.

These fees can soon add up, especially if you’re making regular international transfers.

However, some currency brokers charge no fees.

This is why, for large international money transfers, I’d recommend avoiding the banks and going to a currency broker first to get an exchange rate as a benchmark.

Finding the right time to exchange your money

You’re likely well aware that exchange rates can be volatile.

Most major exchange rates change every 2-3 seconds.

Using an exchange rate company, particularly a currency broker, can help you navigate the ever-changing foreign exchange market.

If you’re making a large international transfer, a lot is riding on getting a good exchange rate.

Timing matters.

Why take on the pressure all by yourself?

It can be hugely beneficial to have an experienced voice in your corner to help track the fluctuating market and discuss the timing of when to exchange your money.

This guidance can relieve the pressure on you and avoid costly mistakes.

About Key Currency

At Key Currency, we believe that international money transfers should be simple, cheap, and stress-free.

We assign you your currency exchange representative who will guide you through the entire process.

We aim to take any confusion out of currency exchange and international transfers.

We are British-based and are open and transparent with the way we operate.

You can find out about us and see all our names and faces, so you know exactly who is dealing with your transfer.

We have attained a 5-Star “Excellent” rating on Trustpilot, based on over 1,900 customer reviews.

Key Currency is also an Authorised Payment Institution regulated by the Financial Conduct Authority (No.753989). For your peace of mind, we use safeguarded bank accounts for all money transfers.

If you need an exchange rate company, request a free quote below and find out what you can save.