Author, Mike Smith

Author, Mike Smith

Last Updated on May 25th, 2024

Below I’ll explain how the foreign exchange market works, why it is important for international money transfers, and how it affects the exchange rate you could receive.

What does the foreign exchange market mean?

The foreign exchange market is where currencies are bought and sold from one country to another.

It can go by different names. It’s also often referred to as the forex market, FX market, or the currency market.

The foreign exchange market determines the price at which all currencies are traded.

By volume, it is by far the largest financial market in the world.

It is also unique in that it operates 24 hours a day across the globe, only closing for the weekend.

How does the foreign exchange market work?

Unlike stock markets, the foreign exchange market has no central exchange.

Trading takes place all over the world, although most occur in leading financial centres such as London, New York, and Tokyo.

Currencies are always traded in pairs.

As a result, the exact value of each currency is shown relative to another currency.

Ultimately, exchange rates are determined using supply and demand for each currency. The big banks create wholesale exchange rates (known as ‘interbank rates’) using an electronic network.

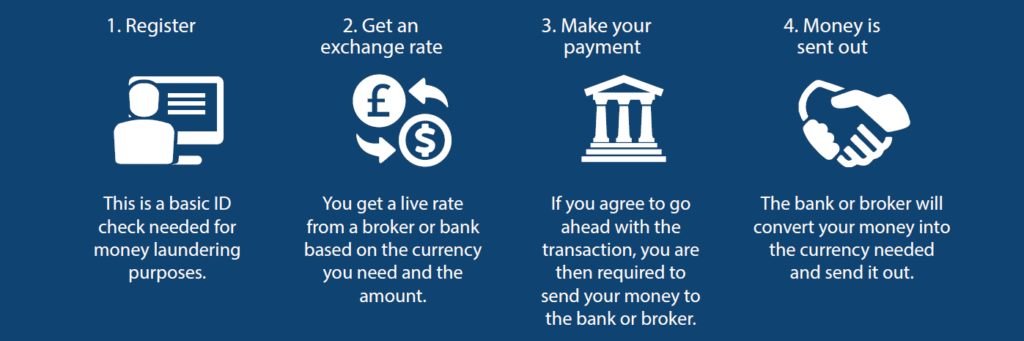

If you plan to exchange money, you can use a bank or a currency exchange specialist.

The exchange rates offered can vary considerably depending on who you use, so it’s always worth shopping around.

Some currency specialists can also assist you with the money transfer process and even discuss how to achieve a better exchange rate.

It’s often best to have someone you can talk to and help you navigate the live foreign exchange market.

Looking to send money abroad?

Why not get a free quote from us below…

What is the importance of the foreign exchange market?

The foreign exchange market plays a vital role in the global economy.

Banks, businesses, and individuals all rely on the foreign exchange market to move money across the world.

The foreign exchange market connects a country to the rest of the world.

Even when you make small exchanges for travel money or large transfers to buy a property abroad, you are accessing the global foreign exchange market.

If you plan to transfer money abroad, it is important to choose the right provider for your situation.

High-street banks generally don’t deliver the best exchange rates and can charge high fees. Their costs and fees can also be hard to find and calculate.

An alternative is to use a currency broker.

Currency brokers specialise in helping individuals and businesses with international money transfers.

What are the types of foreign exchange markets?

Transactions can be defined in multiple ways on the foreign exchange market.

The two most common types of foreign exchange transactions are:

- Spot trades

- Forward trades.

Spot trades are currency transactions that take place and settle within two or three business days.

Think of them as taking place ‘on the spot’.

You’re most likely to use a spot trade if you make an international money transfer for personal reasons.

Spot trades are more straightforward than forward trades.

You agree to the exchange rate, pay your money, and the spot transaction is done.

Forward trades take place at a future date but at an exchange rate agreed now.

The settlement date could be days, months, or even a year in advance.

Forward trades are more popular with businesses as they often use them for fixing the costs of overseas suppliers.

Sometimes individuals will also use a forward trade if they have bought or sold an overseas property but want to remove currency risk while they wait for the transaction to complete (which can take weeks or sometimes months).

Some currency brokers allow you to have a forward trade anywhere up to 1 year away.

This means you lock in an exchange rate now, but settle your trade any time over the next year.

When you place a forward trade you usually have to place a deposit with your broker.

This is called margin.

The margin is typically 5% – 10% of the trade value.

The rest is paid when you want to settle the forward trade.

Once you have agreed on the forward trade, you have essentially fixed the exchange rate.

Of course, the exchange rate could get better or worse after you’ve entered the forward.

But it gives you peace of mind knowing what your exchange rate will be.

And you get the choice of deciding when to settle the trade.

Forward transactions are often used to try and negate the risk in currency markets.

Put simply, they allow you to lock in a rate now for a transaction that will take place in the future.

What are the risks involved in the foreign exchange market?

The foreign exchange market has 3 main risks:

- Exchange rates can be very volatile

- Currency markets are difficult to predict

- Costs of exchanging money can be high

As exchange rates fluctuate continuously, it’s always best to research whether the current exchange rate is good or bad.

A good way to do this is to compare it against recent historical averages.

As a suggestion, look at a currency graph over the last 1, 3, or 5 years and see how the current rate compares to historic levels.

For example, here’s the average for GBP to USD over the last 5 years. You can change currency pairs to fit your transfer at the top of the page.

If the exchange rate is a lot better than average, it could be a good time to make your transfer.

If it’s worse than average, it could be worth waiting, but you should consider the potential future movements.

You may also wish to check out currency forecasts. But as a word of warning, a forecast is ultimately just someone’s opinion. There is a risk that any currency forecast may end up wrong, which could prove costly on the timing of your international transfer.

Another risk to consider is the actual cost of foreign exchange.

Banks and currency specialists make money from the exchange rate they offer and may also charge you additional fees.

In my experience, it’s much better to work with currency specialists who can help you with the timing of your international transfer.

This can substantially reduce the costs of exchanging your money.

Foreign exchange market features

The foreign exchange market has some distinctive features that define how it works.

These determine how all international transfers operate.

Here are the key features of the foreign exchange market:

- Currency values are relative and measured in pairs

- The market operates 24 hours a day with global hubs around the world

- High liquidity means transactions can be done quickly

- Highly volatile as exchange rates change every few seconds

- Exchange rates offered by banks and brokers can vary considerably

How can I achieve the best rate on the foreign exchange market?

For your international currency transfer, you will naturally want to achieve the best exchange rate possible.

This is where you can save a lot of money.

You’re probably aware that plenty of websites online can help you track the movement of currencies on the foreign exchange market.

It is good to stay up to date with the currency you’re interested in.

Local and global economic news can give you an idea of why there are changes in exchange rates.

However, I’d recommend tapping into the expertise and experience of a currency specialist.

Many high street banks and international transfer specialists push you to do your transfer through online platforms, minimising the support and assistance available to you.

This leaves you, and you alone, to stay on top of the markets and the movements and to make the transfer at the right time to get the best exchange rate.

In reality, most people don’t want to do that.

As the foreign exchange markets change every few seconds, it’s not easy to get the timing right.

Some money transfer providers, like Key Currency, can work with you to achieve a better exchange rate.

Having someone available at the other end of the phone, talking you through the transfer, takes some of the pressure off.

This makes it far easier for you to stay on top of the foreign exchange market and could ultimately save you time and money.

Who are we?

Key Currency is a leading currency exchange specialist.

We believe in assigning each of our clients their currency exchange representative.

Your representative will talk you through the transfer and assist you with the process from start to finish.

If you have a particular exchange rate you’d like to achieve, your representative can also alert you when this rate becomes available.

We’re also British-based and independently owned.

Our service has a 5-star rating on Trustpilot, based on over 2,500 customer reviews.

And rest assured, Key Currency is an FCA-regulated Authorised Payment Institution (No. 753989). All money transfers are conducted through safeguarded client accounts.

If you would like to compare our exchange rates, request a free quote below.