Author, Mike Smith

Author, Mike Smith

Last Updated on August 4th, 2024

Find out your options for transferring money from Australia to the UK.

I’ll explain the pros and cons of the available methods and how you can save money on your international transfers.

How to Transfer Money from Australia to the UK

You have two main options when transferring money from Australia to the UK:

- Use a bank

- Use a currency broker

Both are essentially international bank transfers.

From your perspective though, it’s important to realise that they function differently.

Currency brokers are specialists and can make international money transfers cheaper and more efficient.

Currency Brokers will generally be able to offer better exchange rates than banks.

The big high street banks charge considerable margins in their exchange rates.

Banks rely on customers who don’t shop around for their international money transfers.

You may also see banks say sending money is ‘fee-free’.

But this is usually only under certain conditions, and you’ll have to trawl through terms and conditions to find out what they are.

Don’t get misled and remember that the real costs are built into the exchange rate.

Exchange rate costs can be significant, even if they are hidden.

Compare our rates on AUD to GBP and see how much we could save you.

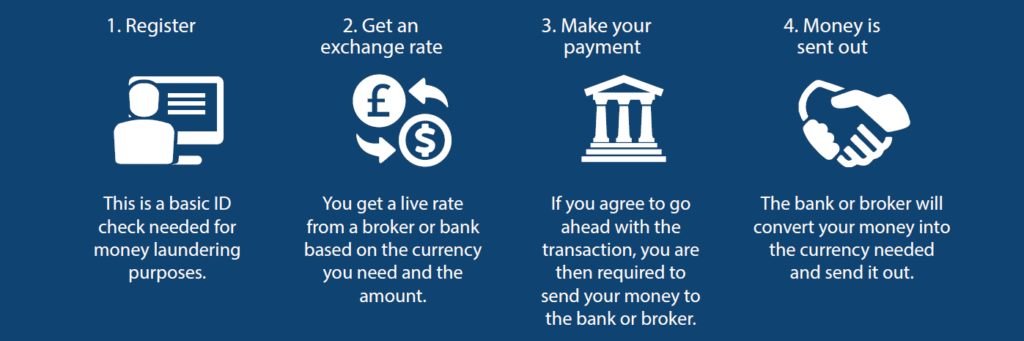

4 Simple Steps to Transfer Money from Australia to the UK

-

Registration and ID check

To get started with your international money transfer, you’ll need to register with your chosen currency broker.

They’ll need to conduct ID checks to ensure the transaction complies with money laundering regulations.

These are normally simple and just require one form of ID.

At Key Currency, once you’re registered, you’ll be cleared to trade and won’t need to do it again.

-

Secure your exchange rate

Getting a good exchange rate is probably the most important part of transferring money from Australia to the UK.

Once you’ve found a broker that offers a fair rate, you’ll need to make the exchange at a beneficial time.

Your currency broker should help you negotiate the market and let you know the best time to make your transfer.

They should listen to your specific needs and help you secure the best exchange rate within the time frame you need.

Once you’re happy, lock in the exchange rate.

At this point, it’s worth noting that banks require you to send in your funds beforehand.

Currency brokers like Key Currency will allow you to lock in the rate before sending in the funds.

-

Send in your Australian Dollars

Once your rate is secured, send your funds to your currency broker.

They will then make the conversion to your chosen currency (pounds sterling) at the exchange rate you’ve locked in.

-

Receive your Pound Sterling

After the currency broker goes to market for your currency exchange, you will be sent your pound sterling.

Be aware though, that international bank transfers aren’t as instantaneous as your usual bank transfers.

But your funds should reach the UK in no more than a few working days.

It’s then as simple as sitting back and waiting for the Pounds Sterling to land in the recipient’s account.

How Long Will It Take to Transfer Money from Australia to the UK?

It typically takes 1-5 working days to transfer money from Australia to the United Kingdom, once you’ve sent the funds. The variation is due to clearing time when the funds reach the bank or the broker, and the time it then takes to reach the account in the UK.

This time frame is generally consistent regardless of the currency exchange provider you use.

Bear this in mind when planning your transfer from Australia to the UK.

If you have any questions about the time it takes, your broker should be able to provide information specific to your situation.

What is the Best Way to Transfer Money Overseas from Australia?

A currency broker is normally the most cost-effective way to send money to the UK from Australia. Currency brokers, as currency exchange specialists, can get much closer to the interbank rate than big banks. This means you’ll receive a much higher amount at the other end of the transfer.

Banks typically have 3-4% margins in the exchange rates.

On a £100,000 transfer, for example, a 4% margin from the banks would cost you £4,000.

With a potential saving of thousands, it pays to shop around and find a broker that is likely to be much cheaper.

Plus, at some point in the past, you’ve probably had one of those annoying experiences with big banks where they can be slow, impersonal, and all-around frustrating to deal with.

Currency brokers, like Key Currency, are specialists and are much more personal and responsive.

Don’t take the risk of dealing with cumbersome banks.

Key Currency assigns you your representative who can guide you through the entire process.

What Details Do I Need to Transfer Money from Australia to the UK?

To transfer money from Australia to the UK, you will need:

- Proof of ID

- Name and details of the recipient (person or business)

- IBAN of recipient’s bank account

- The SWIFT code, also known as the Bank identifier code

Proof of ID is needed for your account setup with your currency broker.

You will only need that if you’re trading with the broker for the first time.

You will need the other details for every money transfer.

The IBAN number can usually be found on the top right-hand side of your bank statement.

To confirm/validate your or a recipient’s IBAN number, use our checking tool!

How Much Money Can I Transfer from Australia to the UK?

There are no legal limits to how much you can transfer from Australia to the UK.

However, some banks have daily transfer limits.

These can be around $50,000 to $100,000.

This often depends on the method you use to make the transfer with the bank.

On the other hand, currency brokers have no limits on international money transfers.

With brokers, you have no need to worry about any sort of limits or breaking up a large amount and having to transfer over multiple days – thus incurring more fees.

Currency brokers are specialists and can, in many ways, make transferring money from Australia to the UK much easier.

Quick Summary

- To transfer money from Australia to the UK you can use your bank or a currency broker.

- It usually takes 1-5 working days for your money to arrive in the UK from Australia.

- Currency brokers will normally provide the most cost-effective way to send money to the UK.

- There are no legal limits on how much you can transfer from Australia to the UK. Some banks have their set daily limits.

Key Currency: A refreshing alternative

Key Currency is a UK-based currency broker that specialises in currency exchange – including from Australia to the UK.

We believe that the best way to conduct international money transfers is through a one-to-one account manager who can offer guidance from start to finish.

Our priority is customer service; we make the process as easy as possible.

Having someone that you can speak to over the phone, alleviates the responsibility and the risk of having to do everything yourself.

As part of our service, we’ll also alert you when the AUD to GBP exchange rate moves in your favour.

Rest assured, Key Currency is an FCA-regulated Authorised Payment Institution (No. 753989), and all money transfers are conducted through safeguarded client accounts.

We also have a 5-star rating on Trustpilot, with over 2,500 reviews.

Click below to find out more or if you’d like a quote for our Australian Dollar to British Pounds exchange rate.

Want to Read More?