Author, Mike Smith

Author, Mike Smith

Last Updated on June 7th, 2024

I will explain how to make an international money transfer, how long it takes, what are the charges, and how to choose a money transfer company.

How to make an international money transfer

If you need to make an international money transfer, you can either use a bank or a money transfer company.

Step 1 – Customer identification check

All new customers will need an ID check due to global financial regulations.

This only has to be once.

Existing customers can skip this step.

These days, most ID checks are quick and easy. Your passport number and address are often all that’s needed.

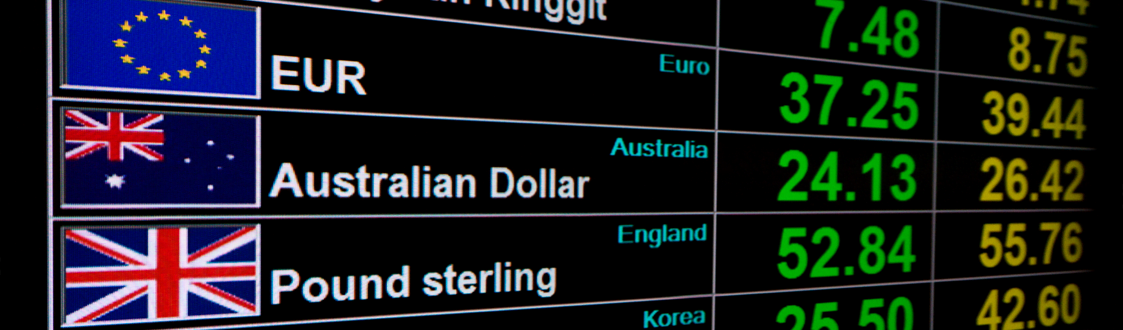

Step 2 – Lock in an exchange rate

Before you can transfer money internationally, you need to lock in an exchange rate.

A bank or money transfer company will quote you their latest rate based on the amount of currency you have and the currency you need to buy.

If you are happy to proceed, the exchange rate is locked-in for you.

Following that, you will be emailed a confirmation with the details of your transaction.

Step 3 – Send in your money

Banks require your money upfront, but money transfer companies can agree on an exchange rate before you send in your money.

This can be handy if you see a great exchange rate and don’t want to miss it.

You will normally be given 1-2 working days to send your money in after securing a rate.

The confirmation email will include the amount you need to send in and where to send it.

Step 4 – Your money is converted & sent

Once your money is received by your bank or money transfer specialist, they will convert it into the currency you need and transfer it to the bank account you’ve requested. That’s it.

How long does an international money transfer take?

It takes 1-3 working days for international money transfers within Europe.

Outside of Europe, it can take between 2-5 working days.

The reason transfer times vary is due to factors such as different time zones, whether your funds arrive in the morning or afternoon, and the efficiency of the recipient bank.

Banks vs money transfer companies compared

Banks used to have a monopoly on foreign exchange.

Fortunately, things have now changed for the better.

Money transfer specialists will do the same job as the banks but at a much lower cost.

Both money transfer specialists and banks use the same secure SWIFT payment network to send money internationally – but can undercut the banks on charges as they have far lower overheads.

It’s pretty obvious why banks can’t offer you the best deals on international money transfers – they can’t.

With billions in annual overheads, they have to charge accordingly.

As a ballpark, the big UK banks charge 3-5% in exchange rate costs.

What that means is if you made a transfer of say £50,000; you could end up paying your bank £2,500 just in exchange rate costs!

The exact cost will depend on the bank, the amount you send, and the currencies involved.

Why pay more than you have to? Get an alternative quote from a money transfer company.

5 reasons to avoid your bank

- It’s not their area of expertise

- Their exchange rates are uncompetitive

- Banks charge transfer fees

- They won’t help you with timing

- You are not their priority

International money transfer fees (& how to avoid them)

Everyone hates paying fees.

And most of the time, they are unnecessary.

In the UK, most of the big banks charge you a fee every time you make an international transfer.

Here’s a summary of fees from the UK’s biggest banks:

- Barclays: £25 (standard) or £40 (faster) if you use a branch. They also charge the recipient £6.

- Lloyds: £9.50 whether you use a branch or go online. The recipient is also charged £12.

- Natwest: £15 for amounts below £5,000, 0.3% of amount if over £5,000 (max £40).

- Santander: £25 flat fee for branch or online.

As you can see, some of the banks charge both the sender and the recipient!

While the transfer fees don’t look massive, a lot of customers think that’s the only cost of their international transfer.

They don’t realise these fees are in addition to the exchange rate charges.

There is a really easy way to avoid paying these fees – don’t use a bank.

Some money transfer specialists, such as Key Currency, don’t charge any fees on international money transfers.

How safe is a money transfer company?

Before using a money transfer company, make sure it is Authorised and Regulated by the Financial Conduct Authority (FCA).

Why does it matter?

An FCA Authorised company must segregate client money.

That means any money transfers will be conducted using a safeguarded bank account designated only for client money.

To find out if a company is Authorised just search for them in the Financial Services Register.

Getting the best exchange rate

Getting a great exchange rate is the best way to lower the cost of an international money transfer.

Even tiny moves in exchange rates can make a big financial difference.

On a transfer of say £50,000, if the exchange rate moved against you by only 0.5%, it would cost you an extra £250.

Moves of that magnitude happen almost daily.

Over the space of a few weeks or months, you can have swings of 3%, 4%, or even 5%.

You can see why deciding when to exchange your money is critical.

However, most people don’t have the time or inclination to watch exchange rates all day.

Nor do they can the knowledge or confidence to know when to lock in a rate.

It’s why you might find it helpful to get some guidance.

A money transfer specialist like ourselves can track exchange rates for you and work with you to achieve a better exchange rate.

Are money transfer companies all the same?

While you may have come across a bunch of money transfer companies, there are some important differences in what they offer.

Money transfer companies fall into three categories.

The first are those that deal with small payments to relatives living abroad. Remitly, WorldRemit, and Ria are examples.

The second type is the online apps; which are do-it-yourself platforms. This group includes PayPal, Transferwise, Revolut, and CurrencyFair.

They tend to be popular with online merchants and younger people who find apps appealing.

The third type is money transfer companies that provide a service, such as Key Currency.

As they can offer personal assistance and guidance, they tend to suit people sending larger sums or those that would prefer to speak to someone.

Like any industry, it’s about choosing a company that best suits what you want.

Quick Summary

- You can use a bank or money transfer specialist to make an international money transfer.

- Most international transfers use the same secure SWIFT payment system.

- Money transfer companies tend to be cheaper and more efficient than banks.

- You can avoid paying any transfer fees by using a money transfer specialist instead.

- A money transfer company that is Authorised by the FCA will keep your funds in a safeguarded account.

- Some money transfer companies are purely online apps, while others will provide a service.

Who are we?

Key Currency is an international money transfer specialist.

Our exchange rates are highly competitive, and we charge you no fees.

What’s more, we provide you with a personal service.

You can have as much or as little assistance as you need.

We can help set up and check your payment information, guide you on exchange rates and timing, and keep you informed at every stage of your transfer.

A lot of other money transfer companies now make you download an app or push you onto a trading platform and make you do everything yourself.

That often doesn’t suit the customers and leaves them vulnerable if something goes wrong.

It’s not the way we operate.

We have attained a “5-Star Excellent” rating rating on the review website, Trustpilot, based on over 2,500 reviews.

As an Authorised Payment Institution with the Financial Services Authority (No. 753989), all our money transfers are conducted through safeguarded client accounts held with major banking institutions.

To find out more or get our latest rates, simply request a quote below.