Author, Andrew Gibson

Author, Andrew Gibson

Below, you’ll find the Pound to Euro exchange rate history, including the highs and lows, historical data, and tips on how to get a better rate.

What’s the live GBP to EUR exchange rate?

For context, the live Pound to Euro exchange rate is €1.1349.

We include today’s live rate here to provide context before looking at historical data.

While the GBP/EUR rate updates constantly with market movements, the focus of this page is on the longer-term picture – highs, lows, and averages that show how the pound has performed against the euro over time.

For real-time conversions and a full calculator, visit our Pound to Euro converter tool.

Please note that this is the mid-market exchange rate, and isn’t available to retail customers. Get a transfer quote instead.

What is the highest pound-to-euro rate ever?

The highest Pound to Euro rate ever was €1.752 on 3rd May 2000.

This was within a year of the Euro’s launch in 1999. Investors were worried the Euro would be a short-lived experiment.

The Pound to Euro rate shot up to over €1.75 due largely to Euro weakness (as opposed to Pound strength).

The lowest pound-to-euro rate ever

The lowest Pound to Euro rate ever was €1.02 on 30th December 2008.

During the global financial crisis the entire UK banking system was nearing collapse.

As a result, the Pound plunged.

The GBP/EUR rate dropped to €1.02 as international investors pulled their money out of the UK.

What is the average pound-to-euro rate?

The Pound to Euro rate has averaged €1.30 over its full history since January 1999.

Therefore at current levels, the Pound sits below the average rate.

But going back to 1999 is not a relevant time scale for most people.

In the past 10 years, the average GBP/EUR rate has been €1.16.

In the past 5 years, the average GBP/EUR rate has been €1.15.

Will the Pound ever recover?

The Pound to Euro rate was €1.30 before the Brexit referendum.

It hasn’t been back to those levels since.

In recent years, the economies of the UK and EU have barely grown at all, so there is not much to separate them.

However, the UK has had higher interest rates than the EU in recent years.

This has helped drive the GBP/EUR rate back above €1.20 on several occasions.

Why Pound to Euro rates you often see online are ‘fake’

You can easily get a Pound to Euro rate off the internet these days.

Websites like XE, FX Street, Oanda, and Daily FX, offer live Pound to Euro rates to 5 decimal places.

Even Google automatically gives you a rate now (albeit to only 2 decimal places).

But here’s the problem…

Most of the Pound to Euro rates shown online are not customer rates.

What you are seeing is something called an ‘interbank rate’.

Customer rates are different.

Interbank rates are used by one bank to trade with another bank.

It’s like a wholesale rate.

Even large corporations, who buy and sell currencies in the billions, don’t trade at interbank rates.

If you just want a rough idea of the GBP to Euro rate, then by all means, use interbank rates as a yardstick.

However, if you want to convert Pounds into Euros (with real money), interbank rates can be very misleading.

Here’s the sneaky bit…

A lot of the websites that show ‘fake rates’ are using them as a hook to lure in customers.

They dangle a teaser rate, then provide a link to a money transfer company.

But when you go to convert your money, you get a different rate.

What can you do about it?

My advice is simple…

If you need to transfer Pounds to Euros, get a genuine quote directly from a money transfer specialist.

Using a real Pound to Euro rate will allow you to budget more effectively and avoid any unexpected shocks later on.

To get our latest rate, please request a quote below.

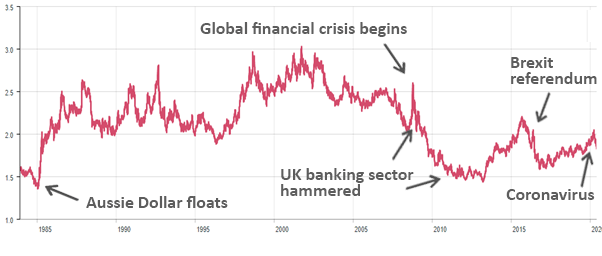

Pound to Euro graph (with the ups and downs explained)

Pound to Euro – its 20-year history in a nutshell

- The GBP/EUR rate started in 1999 at just above the €1.40 level.

- Within a year of the Euros launch, the value of the Pound shot up to €1.752 – which still remains the all-time high today!

- From 2003-2007, the GBP to EUR rate was fairly stable, hovering between €1.40 – €1.50.

- During the global financial crisis of 2007/8, the Pound collapsed hitting an all-time low of €1.02 in December 2008.

- In February 2016, the Brexit referendum triggered another steep decline.

- Since the Brexit vote, the Pound had been clawing its way back up against the Euro (until Coronavirus triggered another sell-off).

- In 2022, the Pound got hit again as high inflation and political instability dented confidence.

On the move? … Here’s a 3-minute video summary

Can you trust Pound to Euro forecasts? (Hint: No)

I’m just going to come out and say it: I don’t trust most exchange rate forecasts.

Most are just publicity stunts or downright nonsense.

Don’t get me wrong; I understand why people are interested in exchange rate forecasts.

No one wants to look silly and exchange their money at the wrong time.

But that doesn’t mean what you find online is reliable or accurate.

The truth is most forecasts are a simple extrapolation of the current exchange rate with a tweak here and there.

But as my old boss would say “To the left is history, to the right is mystery”.

I have yet to find anyone with a crystal ball, magic wand, or secret potion that can predict exchange rates in the future.

There are just too many moving parts in currency markets to make some sort of precise forecast.

But I still don’t think you should blindly exchange your money at any rate.

Timing matters.

It’s always worth seeing how the current Pound to Euro rate compares to the highs, lows, and averages shown above.

Getting the best Pound to Euro exchange rate

While I am skeptical about predicting the future, I’m not suggesting you should ignore exchange rate fluctuations.

The exchange rate you achieve is important.

Even small movements in GBP to Euro exchange rate can make a large financial difference to you.

A lot of people underestimate how sensitive currency exchange is to the rate.

Here’s a quick example… Say you’ve bought a property in Spain for €80,000. The GBP/EUR rate is £1 to €1.15. So the price works out to £69,565. However, in the weeks waiting for the transaction to complete, some bad economic news comes out. The GBP/EUR rate drops down to €1.13. This means your property will now cost you £70,796. That small exchange rate fluctuation added an extra £1,200 to the price. Moves in the Pound to Euro rate of 1-2% happen all the time – sometimes within a day. Over several weeks you can see accumulated moves of 3%, 4%, or even 5%. Now you’re talking substantial money. It’s why timing is critical. For more guidance on finding the best exchange rate for international money transfers or travel money, click through to our dedicated post all about the process! You’ve probably seen that the live Pound to Euro rate moves every few seconds. That might be mesmerising for some people. But most people have neither the time nor inclination to watch the Pound to Euro rate all day. And foreign exchange markets may be something you aren’t familiar with or comfortable with. It’s why a money transfer service may be a good option for you. As a money transfer specialist, we watch rates continuously throughout the day. It’s a key part of what we do. We help our clients achieve a better rate by taking advantage of any favourable moves. Getting some guidance on the Pound to Euro exchange rate can help take away ‘rate anxiety’. It doesn’t matter whether you have a few days, weeks, or even months to exchange your money. During this time, there will be ups, downs, and everything in between. The key is to take advantage of those market markets. That’s a fundamental difference in the service we offer. We will understand your situation and help exchange your Pounds into Euros to your best advantage. A bank or online platform won’t look out for you. They just give you access to a platform and leave you to do everything yourself. Key Currency is an independent money transfer specialist. We offer highly competitive Pound to Euro exchange rates, don’t charge you any fees, and provide you with personal service. As a company, we are open and transparent. We don’t hide behind a cute logo or fancy ‘app’. The names, faces, and backgrounds of our expert team of people are shown on our website. We have gained a 5-star rating on the customer review website Trustpilot, based on over 2,500+ reviews. We’re committed to providing a service of the highest integrity and safety. Key Currency is an FCA-regulated Authorised Payment Institution (No. 753989), and as such, all money transfers are conducted through safeguarded client accounts. To compare our pound-to-euro rates, just request a free quote. You are under no obligation to trade with us.

How a money transfer service can help you with the Pound to Euro rate

Who are we?