Author, Mike Smith

Author, Mike Smith

Last Updated on August 13th, 2024

If you are buying a house in euros, getting the best exchange rate can make a big financial difference to your budget.

I’ll explain the reasons why currency exchange for a property purchase is unique, as well as how you can get a better rate & avoid high charges.

Three reasons currency exchange is different for property purchases

1. The exact timing of your transfer is more uncertain

The legal process for buying a property in Spain, France, or elsewhere, can rumble on for many weeks, or even months.

If you are a British buyer, it creates currency risk.

But before you can pay for your property, the Pound to Euro exchange rate will continue to fluctuate.

While you wait to complete, the price of your overseas property will be changing daily.

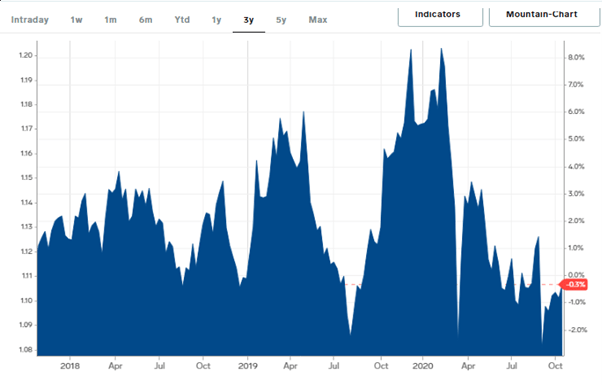

You can see below just how much the pound-to-euro exchange rate moves over time.

While exchange rates are known to have dramatic moves over the years, they can also change significantly over several weeks too.

The last thing you want is to face an adverse currency move and see the price of your property purchase increase unexpectedly.

A money transfer specialist can monitor the exchange rate for you.

If the euro rate has a favourable move, they can let you know straight away.

They can also lock in an exchange rate ahead of time (this is known as a ‘forward rate’).

Being able to fix a forward rate enables you to protect your budget from currency exchange risk.

A fixed euro rate enables you to know exactly how much your house purchase will cost in pounds, regardless of what the exchange rate does.

These features are not offered by banks or online-only providers.

But it can be a great option for foreign property purchases.

2. Property transactions are larger

For a buyer or a seller of a house abroad, it may be the largest currency exchange you will ever do.

But here’s the good news…

Bigger transfers receive better exchange rates.

Put simply; a better euro rate will lower your costs and put more money in your pocket.

It’s worth remembering that even small improvements in the exchange rate can make a big financial difference to you.

3. Using an FCA authorised company is crucial

Property transactions tend to involve life-changing amounts of money.

You want to know your money is safe and will get to the right destination at the right time.

I would strongly suggest sticking to a company Authorised and Regulated by the Financial Conduct Authority.

An Authorised company is required to segregate customer funds.

That means the company must keep all client money in a separate and safeguarded bank account.

For something as critical as a property transaction, you don’t want to take the risk of using an unregulated company.

Paying for your property purchase (the costs explained)

When you purchase a property in euros, there are two types of charges you need to be aware of:

- Fees

- Exchange rates

1. Fees (these can be avoided)

If you use a bank to exchange your pounds into euros, you could face an assortment of fees.

The most common type is a transfer fee.

A transfer fee is a flat fee charged for every international transfer you make.

Here is a summary of transfer fees charged by the UK banks:

- Barclays: £25 (standard) or £40 (priority) if you use a branch.

- Lloyds: £9.50 whether online or in a branch and the recipient is also charged £12.

- Natwest: £15 if under £5,000 or 0.3% (max £40) if over £5,000.

- Santander: £25 flat fee.

As you can see, the fee varies from bank to bank.

Some banks, such as Barclays and Lloyds, also charge a recipient fee.

This can cause friction because the person at the other end may not receive the money they are expecting.

Any deficit in the money received could delay or scupper a property transaction.

There are also other bank fees you need to watch out for.

Another common one is to charge a priority payment fee.

A lot of the big banks seem to charge you to become a ‘priority’. Expect to pay another €30 to €50.

Any amendment, mistake, or cancellation will also cop a fee.

There is a simple way to bypass this assortment of fees…don’t use a bank!

In general, money transfer companies are a lot simpler in terms of what they charge.

At Key Currency, we don’t charge any fees whatsoever.

The cost of our service is included in the exchange rate we quote.

That way you know how many Euros you will receive for your Pounds, and you don’t have to worry about any unexpected fees.

2. Exchange rates (and why they matter)

When you buy a house in euros, the exchange rate tends to be far more important than the fees.

Getting the best euro rate possible can make a big financial difference.

If you’re new to currency exchange, you might think exchange rates are roughly the same wherever you go.

That’s certainly not the case.

Every bank and money transfer specialist set their exchange rates.

Our research found that the big UK banks have an exchange rate markup of 2%-4%.

That might not sound like much…until you do the maths.

Here’s a quick example:

Say you are buying a house in Spain that is priced at €120,000.

If your bank added a 3% charge on the conversion of your pounds into euros, that would work out at £3,200 in exchange rate costs alone.

That’s a lot of money in anyone’s books.

In my experience, the major banks don’t offer the most competitive euro rates.

Why would they?

After all, some customers will automatically use their bank no matter what.

They probably think because the bank holds their money, they have to use them and pay whatever fees are added on.

But these days, customers have alternatives.

The money transfer industry is a well-established and regulated sector that specialises in sending money abroad. In many ways, it is better suited to international property transactions than a bank.

As a quick tip – the sooner you consider the exchange rate, the more opportunity it will provide to get a better rate.

It provides a greater window of opportunity.

You don’t want to leave it until the last minute and end up paying more than you need to.

Beware of bank payment limits

Because property transactions are often quite large, you need to be aware of daily payment limits.

A lot of banks restrict the amount of money you can transfer per day.

The big UK banks usually have a daily limit for online transfers in the region of £50,000 – £100,000.

There isn’t a daily limit if you go into a branch.

But carrying out a transfer within a branch costs you more time, hassle, and money.

In contrast, money transfer companies don’t tend to have any limits or maximums on the amount of money you can transfer.

That can be an advantage for a house purchase, where the amount of money involved exceeds the daily limits imposed by banks.

Put simply; it means you can send all the money in one go.

That way you can bypass extra bank fees, and your money will get there quicker too. Less cost, less stress.

Banks vs Money Transfer Specialists

| Option | Pros | Cons | Best for |

| High street bank | Familiar, money already sat at bank | Added fees & uncompetitive exchange rates | Small payments, convenience |

| Money transfer specialist | Lower cost, efficient service | Need to register | Larger amounts (over £5,000) |

Are all money transfer companies the same?

The simple answer is: no.

I’ll explain why…

Today you will find a lot of money transfer companies are just online systems or ‘apps’.

They might look all fun and friendly, but the reality is they make you do everything yourself.

Some of the better-known platforms are PayPal, Transferwise, CurrencyFair, and Revolut.

That’s just a small selection – new ones seem to crop up all the time.

These platforms suit some people, but not others.

I know they are popular for sending small amounts to friends and family (sometimes called ‘micropayments’) and with online merchants because they need to set up lots of small, regular payments to overseas suppliers.

For house purchases, the amount of money involved is far more significant, and timing and security are more critical.

You need a money transfer provider that is regulated, safe, can transfer large sums directly to a bank account, and offers attractive exchange rates.

Sometimes the differences are in the small things.

If you are unaccustomed to sending money abroad, getting the beneficiary payment details right is vital.

IBANs (the code used to identify foreign bank accounts) are notoriously long.

Different countries have different formats.

For example, in Spain, an IBAN is 24 characters long. Whereas in France, it’s 27 characters.

Some of these online platforms and apps don’t even check the beneficiary details.

They leave it up to you.

It’s a recipe for disaster.

We always go over the details with a client as an extra security step to make sure money doesn’t end up in the wrong place.

Most people want to be able to speak to someone when they are sending a large amount of money abroad.

Having someone on the other end of the phone gives you some reassurance that your money is being looked after.

You are kept informed throughout the process, so you don’t have to log in to your bank account every 10 minutes to check if your money has arrived safely.

It’s just a better way of doing things.

Quick Summary

- Larger money transfers should get better exchange rates

- Exchange rate volatility provides risk and opportunity

- An FCA-regulated company will safeguard your funds

- To avoid bank fees and daily payment limits use a money transfer company

- Small differences in the rate can have a big financial impact

- Not all money transfer companies provide a professional service

Who are we?

Key Currency is a leading money transfer specialist.

The majority of our business is related to international property transactions.

We’ve helped hundreds of British property buyers and sellers in Spain, France, and all over the world, exchange currency safely and efficiently.

We know and understand how the legal and property buying systems work abroad.

Unlike impersonal and inefficient banks, our currency specialists can recommend whether it’s a good time to exchange your money.

As part of our service, we monitor currency fluctuations minute by minute and help you achieve the best exchange rate possible.

We will also help you through the entire process, and make sure your payment goes through safely.

If you have any questions or concerns, we are at the end of a telephone, not hiding behind an app or a website.

That sets us apart from other money transfer providers.

We don’t make you download an app or fight your way around an unfamiliar computer programme.

Our job is to do the hard work for you and help you achieve the best rate possible.

As a company, we are open and transparent.

The names and faces of all our team of people are shown on our website.

Key Currency Ltd is an FCA-regulated Authorised Payment Institution (No. 753989).

As such, we safeguard all client funds, keeping them in segregated bank accounts held with tier 1 banks.

We don’t run positions or aggregate trades, enabling us to track all payments individually.

We also have a 5-Star “excellent” customer rating on the review website Trustpilot; which is the highest rating available.

To make a no-obligation enquiry, please request a quote below.

Author,

Author,